Get Connected

R is for Recovery…or Recession?

With already almost a month and a half behind us in 2023 and the market having bounced nicely to start the year, it is a good time to reassess where we are at, and more importantly, what we think the rest of the year could look like.

Interest Rates/US Economy/Unemployment

This will continue to be front and center as the fight against inflation continues, though we believe we are closer to the end of that battle. We expect inflation to continue to gradually come down and the Fed to have 1-2 more rate increases left in this cycle.

US Consumer. As we wrote last month, consumer spending makes up roughly 70% of the US GDP, so we continue to watch for stresses across the various income demographics as well as the various purchasing categories…

…and while employment numbers in January surprised to the upside, more companies continue to announce layoffs…Disney 7,000 (3% of staff), Dell 6,650 (5% of staff), Zoom 1300 (but 15% of its staff), and Amgen and Johnson & Johnson (though smaller numbers).

Wax on, Wax off. Risk on, Risk off

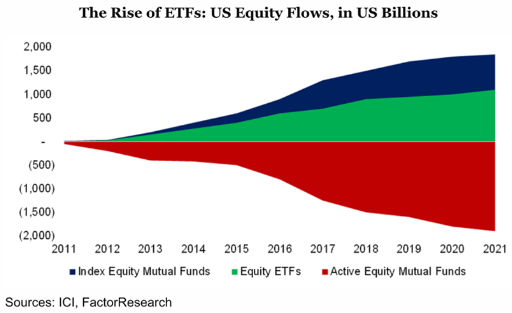

For over a decade the market has seen a significant shift from active investing to Exchange Traded Funds (ETFs) or similar investment vehicles.

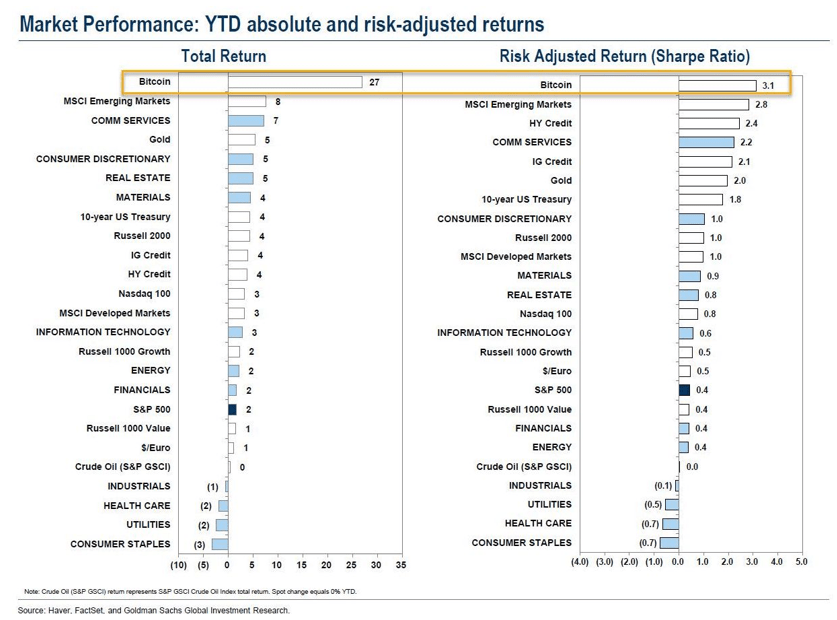

This period has been very challenging for traditional active investment managers in terms of their ability to outperform their benchmarks. A by-product of this has been an “all or nothing” view on the market as well. Many in the industry have used the terms “risk on” and “risk off.” Though there are many market pundits who have been suggesting that this is the year for active management, the returns thus far have shown otherwise. We stumbled upon this chart and wanted to share it with you, as it continues to show the generally binary nature of the market. Basically, the riskiest assets have shown the greatest return, which is almost a mirror image of what took place in 2022.

Patience…being paid to wait.

So what do we favor now? We have often spoken of the market being range bound for at least the first half of the year and we continue to think that will be the case. The range we have discussed has been the S&P500 in the low 3000s to somewhere in the 4200 range at the high end. With the S&P 500 up nearly 7% year to date at 4,090.46 (as of 2/10/23) and the added risk that inflation has a short term re-acceleration, we advocate patience, and with interest rates in various fixed income vehicles ranging from 4 to 5%, investors are being paid nicely to wait for the next opportunity.

Our most recent articles:

- Happy Presidents Day!

- The Health Savings Account (HSA)

- Happy Holidays!

- “There is no way to peace, peace is the way.”

- Hello Fall.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use