A Focus on 2023 — The Potential Ahead

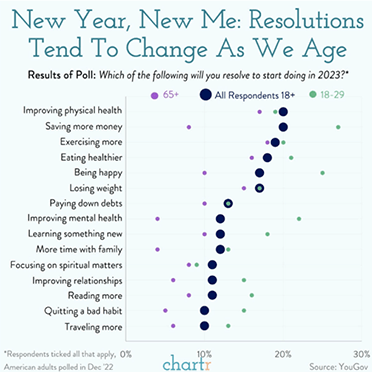

We hope everyone had a great holiday and wish you all a Happy and Healthy New Year to start 2023! With the new year comes resolutions. As we like charts, we figured this would be a good “first chart” to start the year on a slightly light-hearted note.

With the S&P 500 ending 2022 -19.4% and Long Term Treasury Bonds -39.2% (as tracked by EDV), it is definitely a year we would like to put in the rear-view mirror and instead try to focus on the opportunities in front of us in the new year.

Interest Rates/US Economy/Unemployment

While the New Year generally brings hope and optimism to investors, unfortunately the same concerns remain as to when will the Fed stop increasing rates. As we have said previously, a slowdown in the US economy and weakening employment environment, would be the conditions that need to be met for this to occur. With inflation now easing, and US corporate earnings slowing, the focus is now on unemployment. As we see more layoffs announced in the last week from 2 technology bellwethers (Salesforce Inc laying off 10% of its staff and Amazon cutting 18k employees), a slowdown in employment is becoming more apparent.

With an end in rate increases near. The focus will shift to corporate fundamentals and general economic growth. Consumer spending makes up roughly 70% of the US GDP, therefore it is one area that should be monitored closely. While employment is still strong (though weakening) and housing prices are flattening out (and declining slightly in some areas), the savings rate has fallen sharply since the lockdown and are now at a level not seen since 2005.

With this backdrop, we are cautious, as market earnings expectations and valuations do not fully reflect these negatives.

China Reopening

With China finally exiting the zero-COVID policy, after a little “urging” from some protesting citizens, there should be a little relief from some of the pressures this created in both consumer demand and supply chain disruptions. Net-net this should be viewed positively and may help dampen some of the slowing growth being experienced by developing economies as well as improving the inflation situation as millions of workers were confined to their homes and manufacturing was stymied causing many disruptions throughout supply chains worldwide.

Japan

In late December, the BoJ (Bank of Japan) surprised the markets by widening the 10yr JGB yield band from +/-25bp to +/-50bp while maintaining accommodative conditions. While relatively benign on the surface it is something that continues to bear monitoring as the reason was to “improve market functioning.” Additionally, Japan remains one of the last regions to not participate in sharp increases in interest rates, while other developed nations have been aggressive in increasing rates to fight inflation.

Finally, we would like to end with something interesting we came across. We have in the past talked about potential areas of growth in the upcoming decade and one of the areas we have mentioned is Artificial Intelligence (AI). Late last year, a company called OpenAI released a chatbot called ChatGPT. While there is still a way to go, this is by far one of the most advanced released to date. There is a waitlist to sign up now and as we write this, also some chatter that Microsoft is interested in potentially making a $10b investment in the company. We would love to hear your feedback on this. Unfortunately, one thing it could not answer for us is what the market is going to do this year, but we remain optimistic that once the dust settles over the next several quarters, there will be some opportunities for the longer term.