Get Connected

January 2025 Insights

“Winners never quit and quitters never win.” – Vince Lombardi

Happy New Year to all! We wish everyone a safe, healthy and prosperous year and hope that 2025 has gotten off to a good start as we look forward to what the year has to bring.

In honor of Quitter’s Day (the second Friday of January when many people abandon their resolutions for the New Year) and the start of NFL Playoffs, we start with this quote. After a nice bounce post-election in the S&P 500, the market has since settled and is roughly flat since November 5, 2024. This newsletter will have a slightly different format to start the year, as we review the year that was and discuss some things to look out for in 2025.

2024 Year in Review

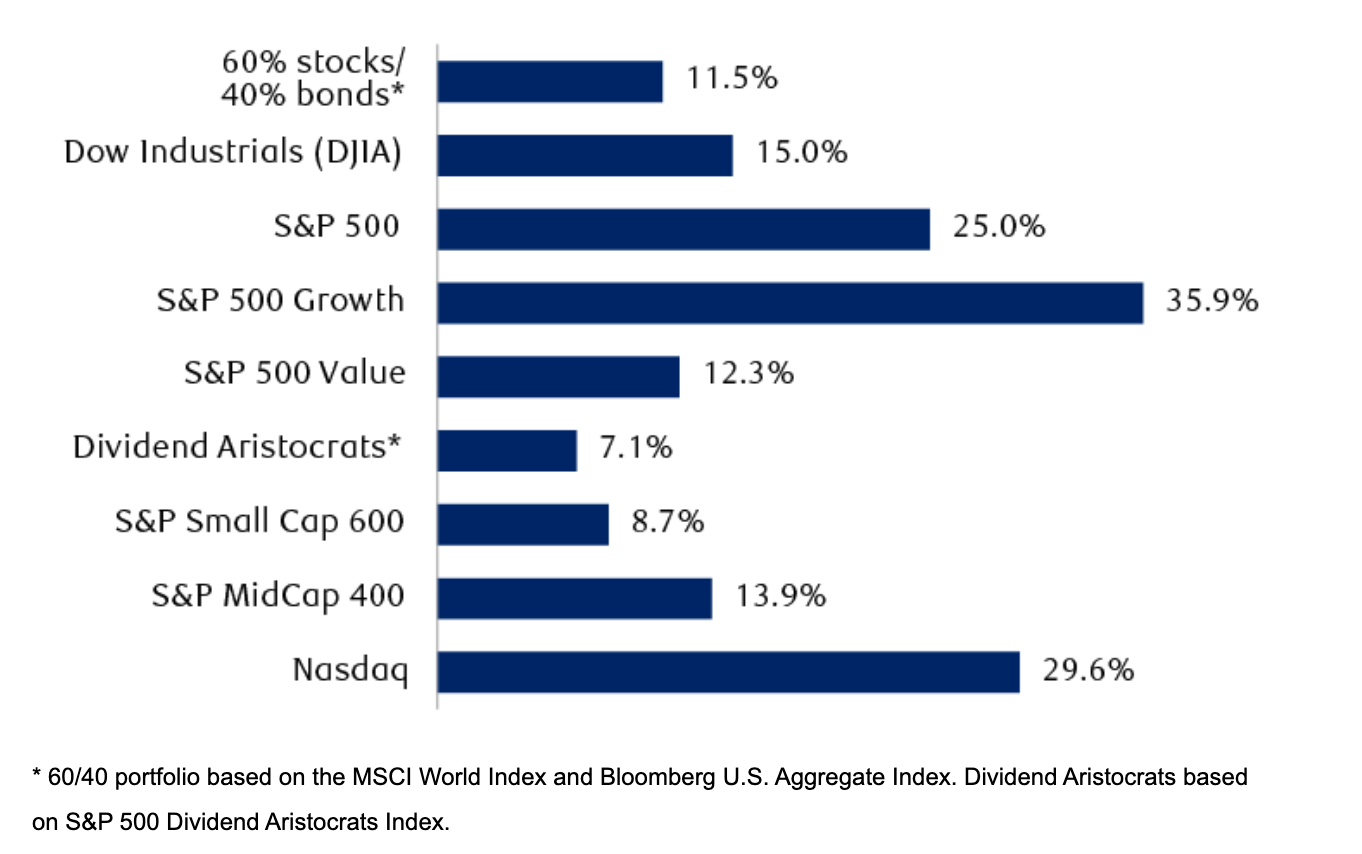

Below are the full year returns of various indices (including dividends) through 12/31/24.

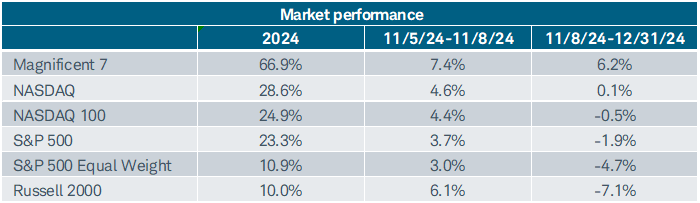

As can be seen from the chart above, the market was once again, led by large cap growth equities, more specifically, the “Magnificent Seven” (Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta Platforms and Tesla). These stocks accounted for more than half of the gains of the S&P 500. It is also important to note that a, traditionally, more diversified portfolio of 60% stocks and 40% bonds was “only” up 11.5%.

While the S&P 500 closed near the highs for the year, unfortunately, the breadth of the rally petered out as the S&P 500 Equal Weight and Russell 2000 (Small Cap) were -4.7% and -7.1% respectively from 11/8/24 till the end of the year.

What are we focusing on in 2025?

Interest Rates.

The 10-year Treasury is now up over 100bp since it’s mid-September low and now sits at (as of 1/10/25) 4.67%. When the rate cut cycle began last year, the expectation was that yields at the end of 2025 would be closer to 3%. With the continued strength in the economy and somewhat stubborn inflation, the consensus expectation is now for only 1-2 cuts by year end, with Bank of America even suggesting zero cuts with a risk towards an INCREASE in rates as the next move.

We are more of the belief that nothing is linear, and while inflation may uptick slightly in the near term, some of the major issues that drove it up significantly have been addressed and expect it to continue to moderate towards the Fed’s goal of 2% over the next 12-18 months.

The Market.

Earnings for the S&P 500 in 2025 are targeted at approximately $275/share which puts the multiple at roughly 21x. With expected growth of 13.6% in 2026, in less than 12 months, the market multiple will be roughly 18.5x which would be (probably not coincidentally) right around the 10-year average of 18.2x. While the market is not “cheap” we would consider it more “fairly valued” based on current growth expectations and therefore, the focus, as it usually is, will be on companies to meet or beat growth expectations for the market to trend higher.

Other Factors

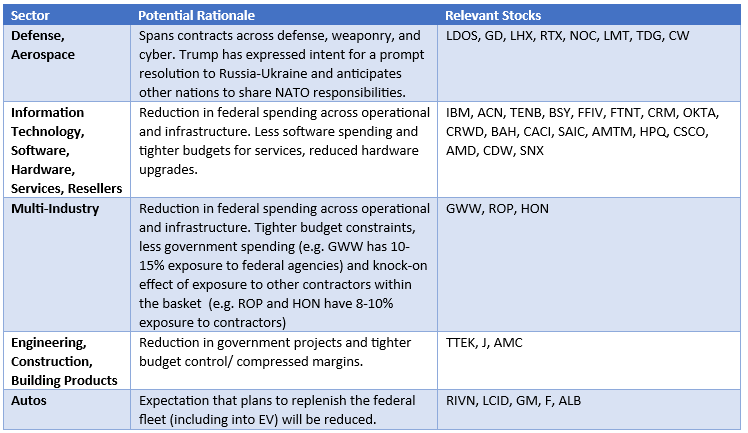

DOGE.

What is a trillion here or there between friends? This will be interesting to monitor as the potential to CUT $1-2T from inefficiencies in the government over the next several years could be very impactful. Below is a small sample of some potential impacts…

Tax Cuts.

There will be several areas to follow here. The expiring tax cuts from the 2017 Tax Cuts and Jobs Act are set to expire in 2026. With the current Republican majority in Congress, this looks likely, including an end to the $10,000 cap on state and local tax deductions (SALT).

Global Unrest.

While hopes are high that the new administration will be able to address the situations globally, there have yet to be significant changes to the conflicts in the Middle East and Russia/Ukraine. Additionally, we should continue to monitor China as their economy continues to struggle.

Debt.

With the national debt at approximately $36T and the new administration expected to continue to add to it, it is now expected to cross the $40T mark by 2026. With the 30-year Treasury right around 5%, the interest expense alone will be $2T (roughly 7% of GDP).

Anecdotes.

- China’s population is expected to shrink by ~51M over the next 10 years as the country continues to grapple within enormous demographic headwinds. – Bloomberg

- OpenAI planning a “frontal assault on Google” as it considers its own browser and potential search partnerships; OpenAI could power AI features on Samsung devices, dealing a possible blow to Google – The Information

- Yields on China’s 10-year sovereign debt hit record lows despite Beijing’s recent stimulus announcements, suggesting growing concern the nation will fail to avoid a deflationary spiral mirroring 1990s Japan. – Bloomberg

The recent pullback in the S&P 500 has it at a fair value relative to its 10-year history. While inflation and stronger jobs growth have crept back as a concern for interest rates, we believe the trend towards normalcy should continue and allow the Fed to eventually get back on the path to lowering interest rates. This will continue to serve as a potential floor for equity markets. After two strong years in the S&P 500, we do expect growth to continue and to broaden out, albeit at a more modest rate, which makes the fixed income opportunity more attractive as we expect the current yield plus potential upside in the underlying value of the bond to be more similar to that of the broader equity markets this year.

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use