“So it begins.” - King Theoden, The Lord of the Rings: The Two Towers

As we enter the first days of fall and finally have that first interest rate cut behind us, we always ask ourselves, “What next?” This past week, saw a plethora of analysts provide historical performance post rate cuts, so instead of trying to reinvent the wheel, we will share with you a summary of “The Week In Charts.” We are always reminded of that favorite caveat “past performance is not indicative of future performance,” so we will try our best to provide some perspective to these charts and tables.

Interest Rates.

So how does the market perform after the first interest rate cuts and what sectors perform best? These charts and tables were published by Canaccord Genuity Capital Markets. This first chart shows that when the initial rate cut occurs, when the S&P 500 Index is near a high, the market tends to do well over the next 12 months, with the exception being the financial crisis in 2007/2008…

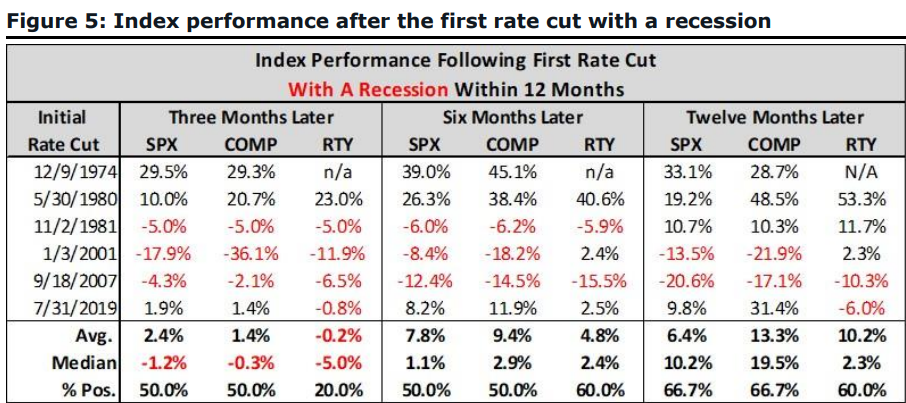

Unsurprisingly, if a recession occurs within 12 months of the first rate cut, one would expect a much more mixed/mediocre performance of the various indices (S&P 500, Nasdaq and the Russell 2000) versus if a recession were to NOT occur within 12 months.

The two worst “with a recession” scenarios took place after the dot-com bubble burst in 2001 and the Great Financial Crisis in 2007/2008. While employment and credit are showing signs of weakness, we do not expect anything near the situation that took place in 2007/2008 as corporate balance sheets are far stronger and the larger banks are less leveraged. The current high expectations for growth towards Artificial Intelligence (AI) and obesity drugs is a bit more similar to the dot-com bubble, however the biggest difference is that today’s companies are highly profitable versus their 2001 counterparts.

So what sectors perform better? Ultimately what the following tables show is that the companies that have growth and can show positive surprises relative to expectations will be the ones that outperform.

Elections.

As most of us are expecting, currently, it is expected to be a tightly contested election for the presidency. That being said, however, we still believe that ultimately both houses of Congress will be divided, and any majority will be by a narrow margin which ultimately will lead to gridlock for any major policies. Historically, gridlock has been broadly positive for markets and with the interest rate backdrop, that should hold this time around. That being said, there are some areas to consider where specific companies or sectors could be impacted:

- The Trump Administration: (1) privatize Fannie Mae and Freddie Mac; (2) increase US oil-drilling and defense spending with less M&A restrictions; (3) tariffs.

- The Harris Administration: (1) health care insurance pricing concerns; (2) increase scrutiny of Big Banks and Big Tech; (3) renewables and less likelihood of Inflation Reduction Act incentives being repealed.

Anecdotes.

- $4.5 Trillion worth of US equity options expire 9/20/24. This is the largest September expiration on record. This is also the 4th largest option total expiration on record (only June 2024, December 2023, and March 2024 were larger). This will unclench the gamma and the market will be able to move more freely (either to the upside or downside) after today.

Source: Goldman Sachs Investment Research

- Ally Financial (ALLY) – at a conference the company mentioned: "Credit challenges have intensified; borrowers are struggling with a high inflation and cost of living, and now, more recently, a weakening employment picture; committed to its 15% ROTC target, but the road is getting harder. Lease gains came in a little bit soft and that put additional pressure on NIM in the quarter. Those factors will likely put 6 basis points to 7 basis points of linked-quarter pressure on the company's net interest margin."

- J.P. Morgan (JPM) at a conference the company is guiding Q3 IB fees/trading below estimates, Q3 IB fees are tracking up ~15% Y/Y (below the Street’s ~24% forecast) with trading flat-to-up 2% overall (below the Street’s ~6.3%), and the company warned that the Street consensus for 2025 NII is “a bit too high” given the likely trajectory of rates.

- Oil demand growth continues to “rapidly decline”, due primarily to weaker consumption in China (consumption in China contracted Y/Y for the fourth straight month in July), while supply on the rise. – International Energy Agency (IEA)

- US homebuilders are facing their biggest credit crunch in more than a decade, with banks cutting lending for residential construction by more than 10%. US banks had $92bn of loans outstanding to fund the construction of dwellings for one to four families in the quarter to the end of June, down from $102bn a year ago. This is the largest year-on-year drop in more than a decade, according to an analysis by BankRegData of the most recent data from the Federal Deposit Insurance Corp. It was also the fifth consecutive quarter in which lending for home construction fell. – Financial Times

In summary, the rate cut cycle in its early stages should provide some downside protection to the overall market as the Fed can become more aggressive if necessary. Our concern over time is as the rate cut cycle matures, investors will be faced with slowing economic growth. This may cause their focus to shift to longer-term concerns regarding the national debt which can only be addressed by raising taxes and cutting government entitlement programs which will make it more difficult to identify and “lock in” higher fixed income opportunities in traditional investments.

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.