Institutional Investing

A customized investment strategy — always in perfect alignment with your goals.

Elevate your financial objectives.

The investment team at Bergamot has a long history of working with institutional investors — ranging from Corporate Pension Funds and Endowments, to Foundations and Fund of Funds. We offer a unique set of customized solutions, focused on both traditional and non-traditional investment opportunities.

You'll receive thoughtful, unbiased advice from our team of experienced industry professionals.

Working closely with your investment team, we first develop a deep understanding of your organization's overall financial objectives. We then customize investment solutions using our proprietary models that align with your risk tolerance, time horizon and income needs to ultimately help you reach your investment goals.

Our dedicated team of client service professionals brings a high level of industry experience and knowledge, working seamlessly alongside our investment team to deliver a world-class experience to our clients. Our ultimate goal is to partner with you to elevate your organization's financial objectives and fulfill its fiduciary responsibilities.

The evolution of our investment process.

Over the past 43 years, there has been an evolution of our investment process. What started with valuation and earnings revision analysis, has evolved into a more dynamic process that captures information in real time and processes that information to identify potential buy and sell opportunities in our equity universe.

Understanding the core of our investment process

We utilize a comprehensive 3-step investment process to create customized portfolios that are uniquely tailored to your investing needs.

The importance of investor sentiment

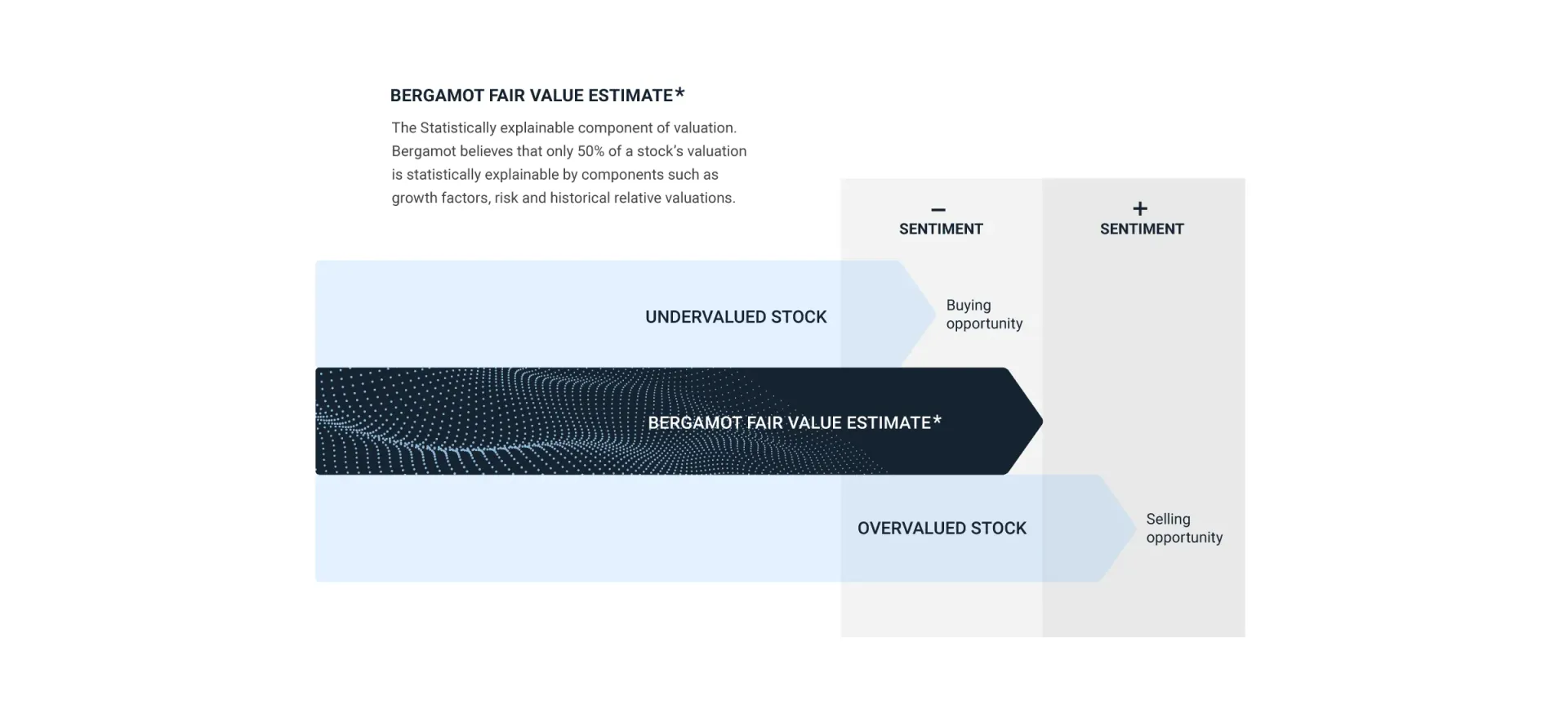

Investor sentiment is an important factor in determining what is being discounted by investors and may allow us to take advantage of opportunities to buy where we feel multiples may be able to expand — and sell where we feel investors are too optimistic about a company’s growth prospects.

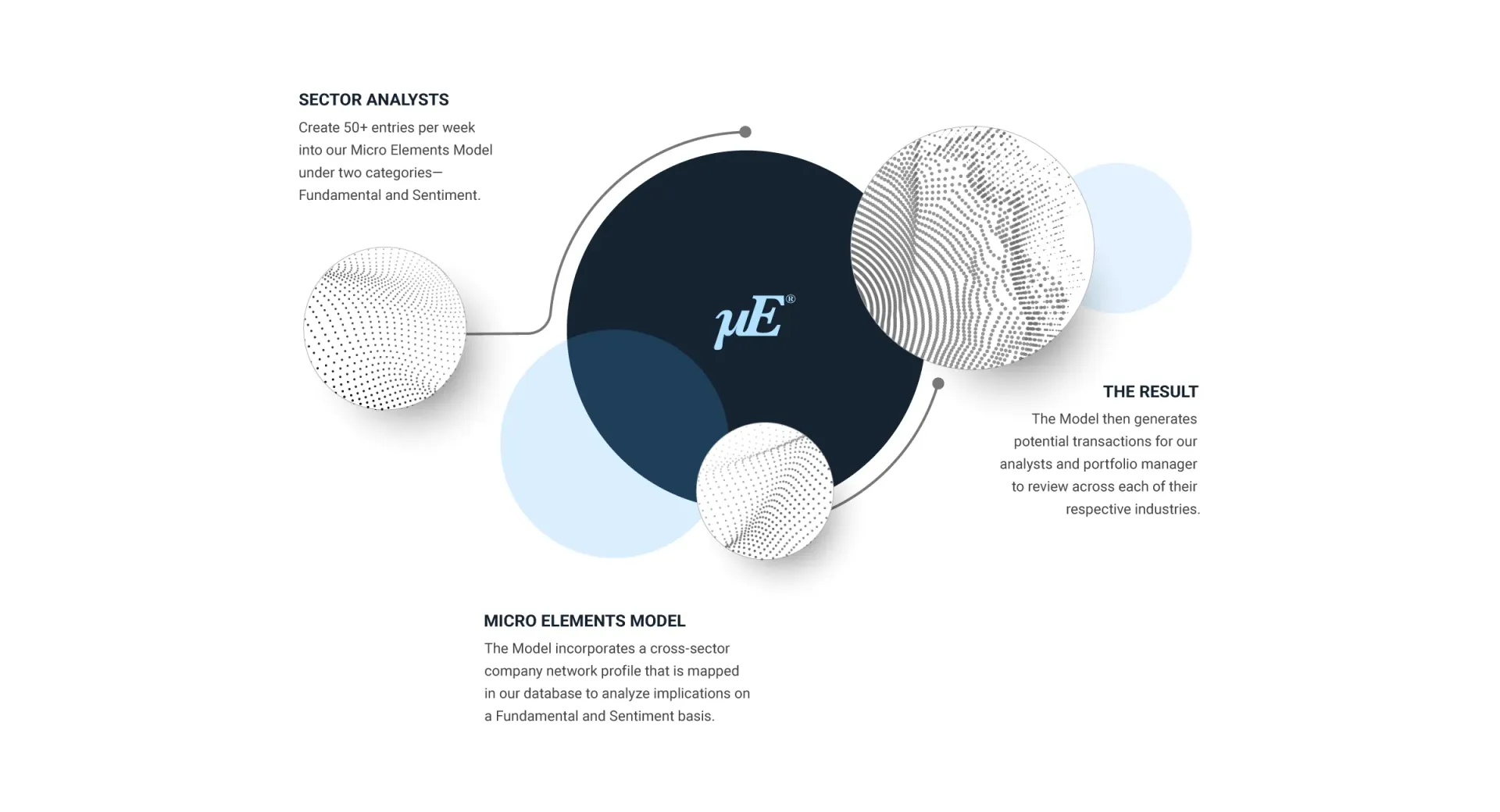

Our unique Micro Elements model helps us to capture investor sentiment — the component of a stock price that is not statistically explainable. Combined with our knowledge of industry and sector dynamics, this allows us to potentially identify the best time to enter and exit an investment position.

We welcome an opportunity to learn about you and your needs.

Insights

Thoughtful perspectives from our wealth management team to help navigate what matters to you most. Discover the latest on everything from market news and trends — to wealth planning and emerging investment opportunities.