Spring into Summer

With Memorial Day weekend having just passed, we kick off the unofficial start to summer. While there was a slight scare in April that inflation was returning, that concern has passed and investors have refocused on the economy and fundamentals. Here is a recap of what has happened over the past several months and what we continue to think about regarding the market and potential opportunities.

Inflation and Interest Rates

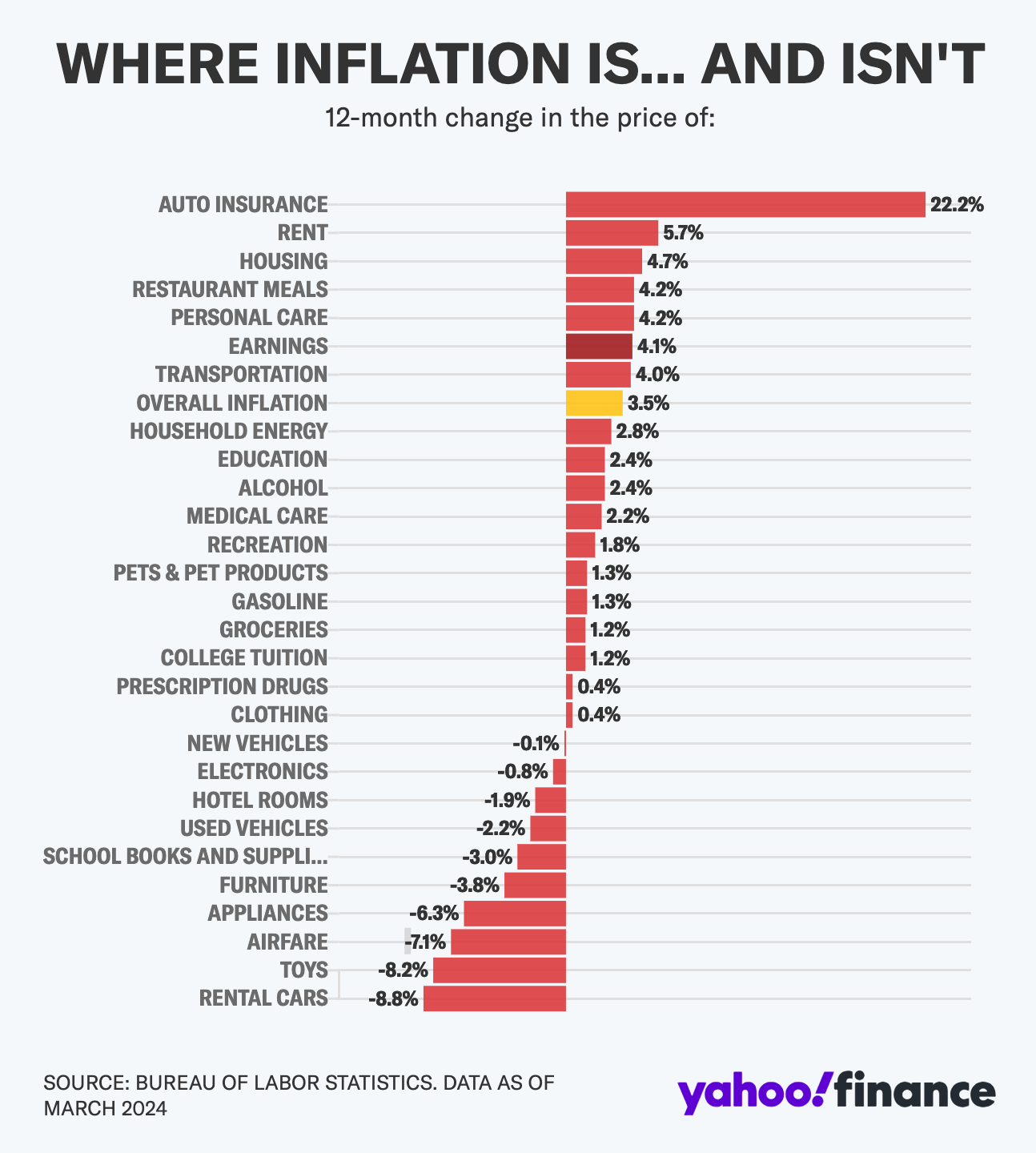

We cannot seem to get past this topic. There has been a little back and forth over the past several months as to whether inflation is coming back or is slowly subsiding. Our position is that it is gradually coming down, though nowhere near as fast as investors originally hoped for earlier in the year. Looking at the table below from March, most of the categories above where inflation is currently at have seen weakening data points since. Rent and housing increases are slowing if not outright declining now in some regions, and personal care companies and restaurants are reporting weaker profits due to weakening demand, especially from low to middle-income customers.

Where is there Growth?

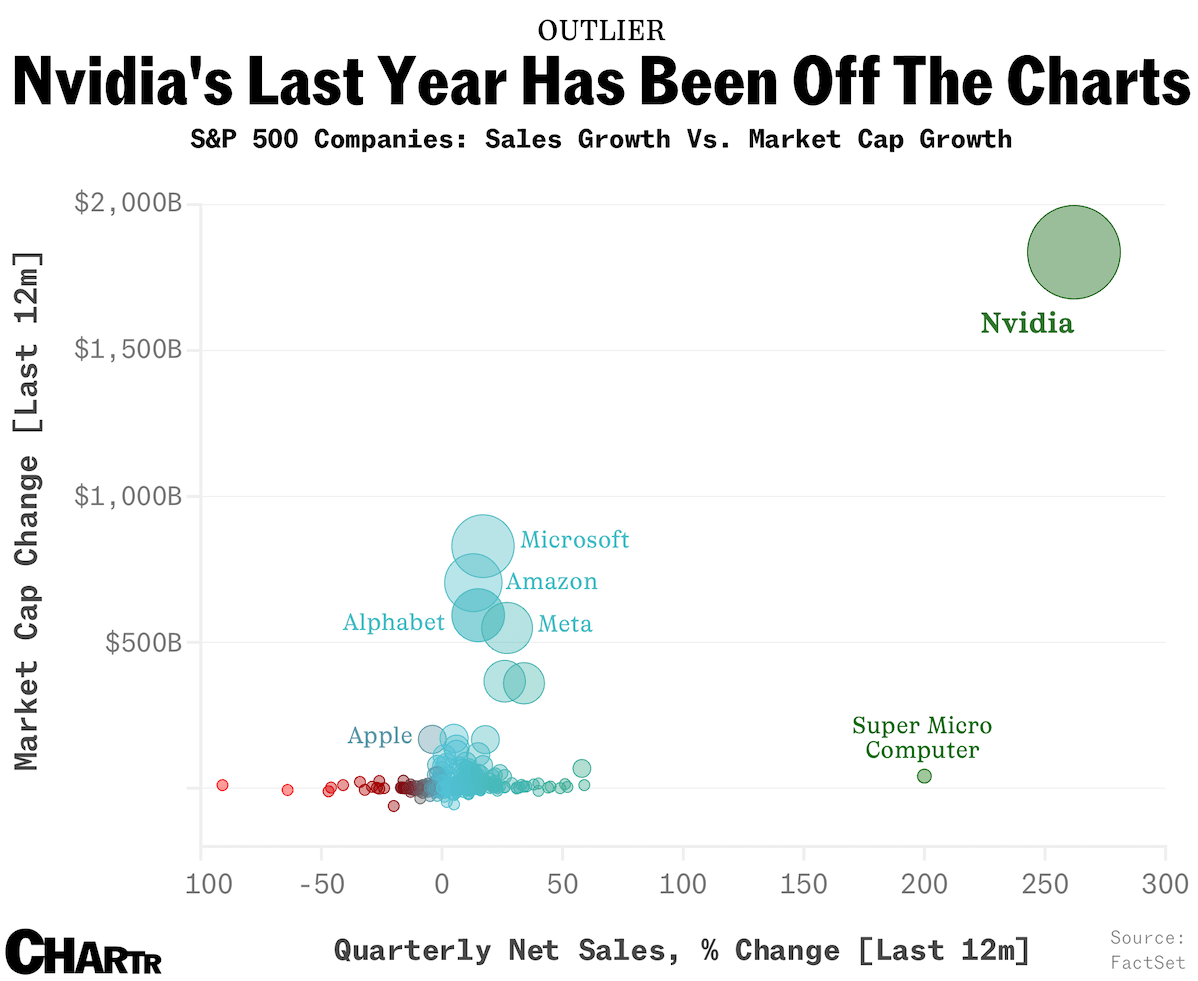

Artificial Intelligence (AI) is an obvious area of growth led by Nvidia Corp (NVDA), as can be seen from the chart below.

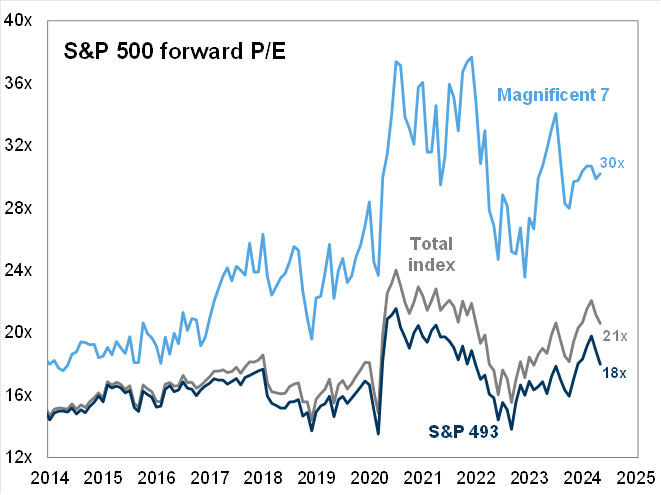

Most investors, casual or professional, are very aware of the returns of Nvidia Corp as it has been the poster child for investing in AI. While we will refrain from offering an opinion on the stock in a public forum such as this, we would, however, like to provide a fundamental framework on how to justify the current value. Previously, we have discussed valuations on stocks. While Nvidia Corp in FY2022 (CY2021) had revenue/earnings per share of $26.9b/$3.80, Goldman Sachs projects in FY2027 (CY2026) the company will have $203b in revenue and $48.46. This would put the stock at a PE valuation just slightly above 20x, which would be considered reasonable for a company that would be a leader in its industry and growing at a high growth rate (See the table below for the Magnificent 7 vs the rest of the S&P 500).

Source: Goldman Sachs Global Investment Research

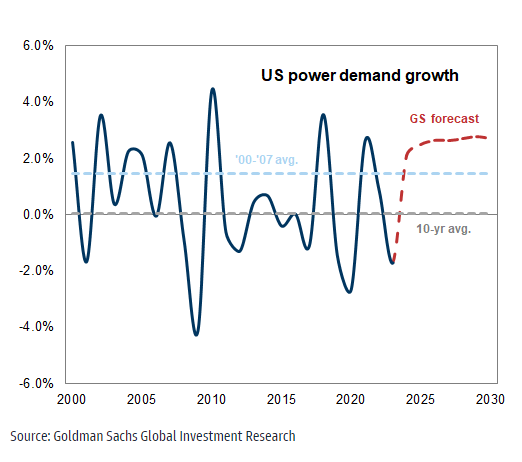

... other beneficiaries of the growth in AI are Utilities, a category we have highlighted in the past.

As can be seen from the chart, growth in US power demand has been choppy at best. Should the growth in demand be more consistent in the future, as Goldman Sachs is projecting the rest of the decade, utility stocks along with their high dividends could be a solid candidate for outperformance.

Elections

The ho-hum market that is currently focused on inflation data will soon begin to focus on the upcoming election in November. While it is still hard to imagine that the two front-runner candidates will actually be running against each other in November, it is important to also focus on the make-up of the Senate and Congress, as the winner being able to execute their legislative agenda will be equally as important.

Anecdotes.

- Retailers begin cutting prices following years of increases in response to cooler consumer demand – Walmart and Target in the last week talked about how they are cutting prices in a bid to drive traffic. – Financial Times

- China’s mega banks are urging branch managers to lend to state-owned companies that buy unsold homes, offering a quick show of support for the government’s housing rescue package unveiled last week. – Bloomberg

- Walmart is cutting hundreds of corporate jobs and ordering remote employees back to the office. – Wall Street Journal

- McDonald’s is looking to launch a $5 meal plan in the US, a sign the company is becoming more aggressive on price to recapture market/mindshare as consumers dial back spending. – Bloomberg

- Novo Nordisk is now the biggest company in Europe; its market cap is bigger than the entire Danish economy – Goldman Sachs

The S&P 500 continues to trend strongly for the year, up 11.27% through May 31. The strength continues to be driven by the larger constituents of the index. Growth continues to be rewarded as investors continue to migrate towards companies that can exceed expectations. As we near the elections, we expect the market to pause as the different outcomes will be assessed. Once we get through that, investors will likely refocus on the economy and fundamentals as the hope and anticipation of rate cuts should continue to limit the downside of the overall market.

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.