“Summertime and the livin’ is easy…” – Porgy & Bess

We hope everyone had a safe and relaxing July 4th weekend. With the summer now in full swing, heat and humidity included, we have half the year under our belt. While the situation seemed like we were going to cruise into the elections in November, the recent debate has created a little bit of uncertainty. As the saying goes, “Grab your popcorn…!”

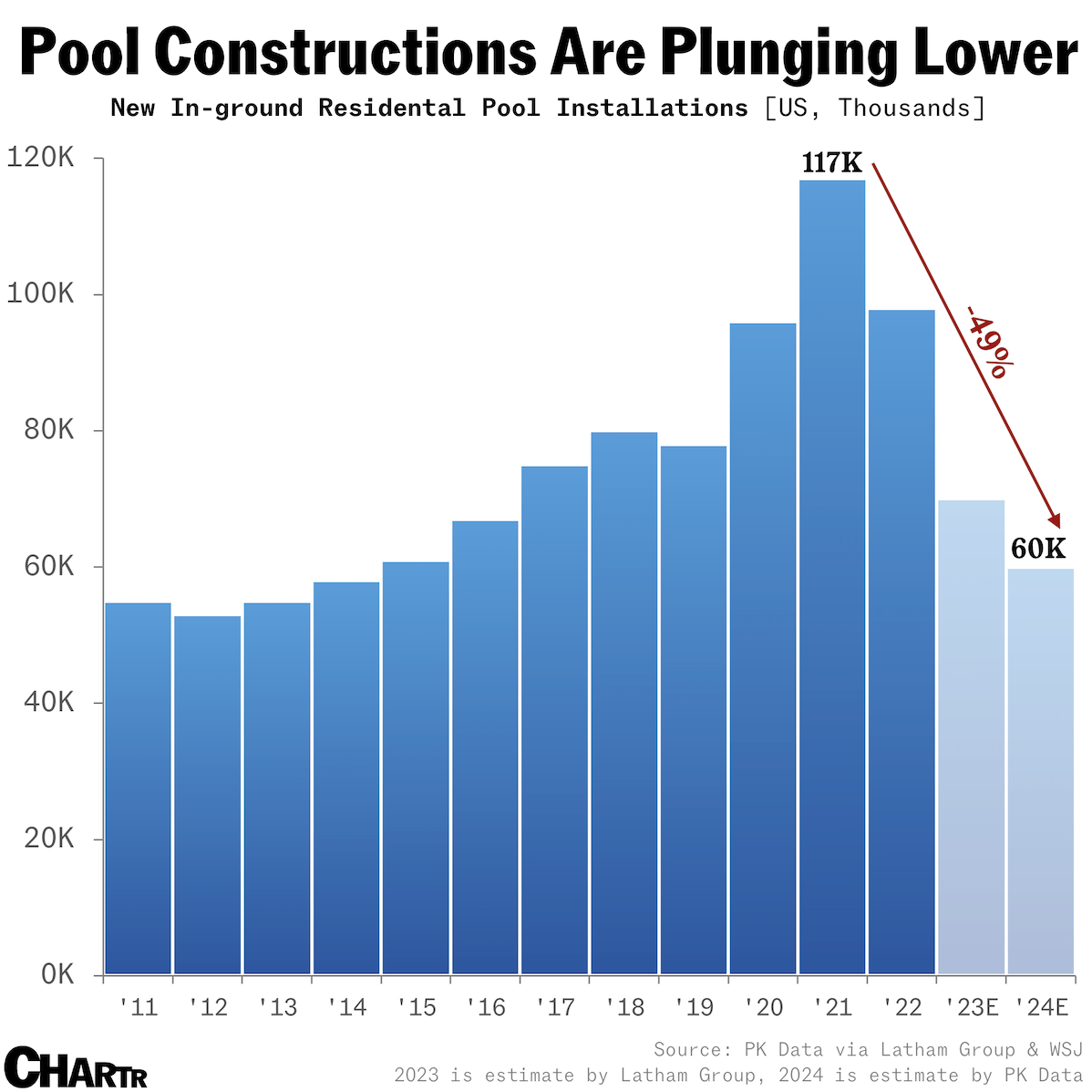

Interesting construction fact for the summer:

Elections

For the first time in a long time, we will not lead with commentary on Inflation or Interest Rates (that will be next). One month later, and we now feel more comfortable with our previous statement about it being hard to imagine that Presidents Joe Biden and Donald Trump would be running against each other in November. Despite his defiance, President Biden’s debate performance and subsequent interview have raised more questions about his ability to fulfill his obligations as President. Unfortunately, most of the candidates mentioned to replace him trail in the polls, even to him, let alone to former President Trump.

The Economy (Interest Rates)

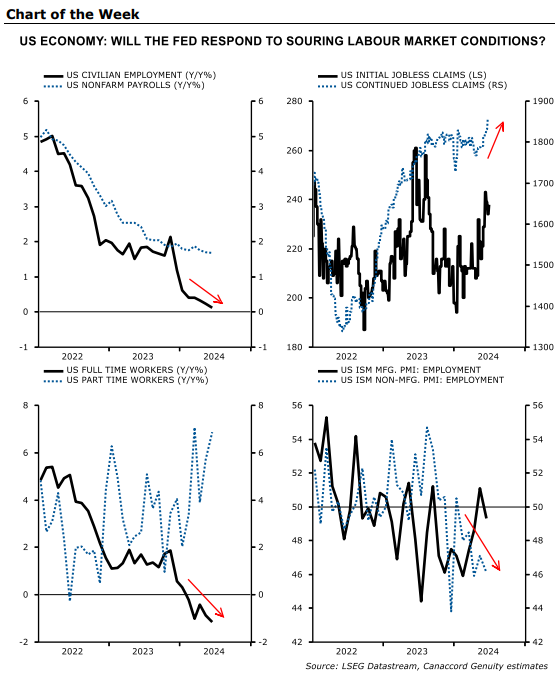

Labor markets are finally easing. While the headline number for non-farm payrolls was better than consensus expectations, the beat was primarily driven by strength in government hiring, which is generally not viewed positively. Additionally, the economy is adding part-time jobs while shedding full-time roles.

Growth Concerns?

We have written several times of late about Nvidia Corp. (NVDA) and growth in Artificial Intelligence (AI). Goldman Sachs has been a proponent of this for years as they believed that it would add a full point to global GDP in the next several years. Two weeks ago, they published a report with their Head of Global Equity Research and an MIT Professor posing the question, “Gen AI: Too Much Spend, Too Little Benefit?” In short, the belief is that (1) only a fraction of tasks exposed to AI will be cost effective to automate in the next 10 years (5% of all tasks) and (2) the $1T price tag to develop and run AI technology needs to solve complex problems, which it is not currently able to do. While most of the research team at Goldman Sachs does NOT agree with these views, it is one of the earlier “warnings” backed with some thorough analysis.

Anecdotes

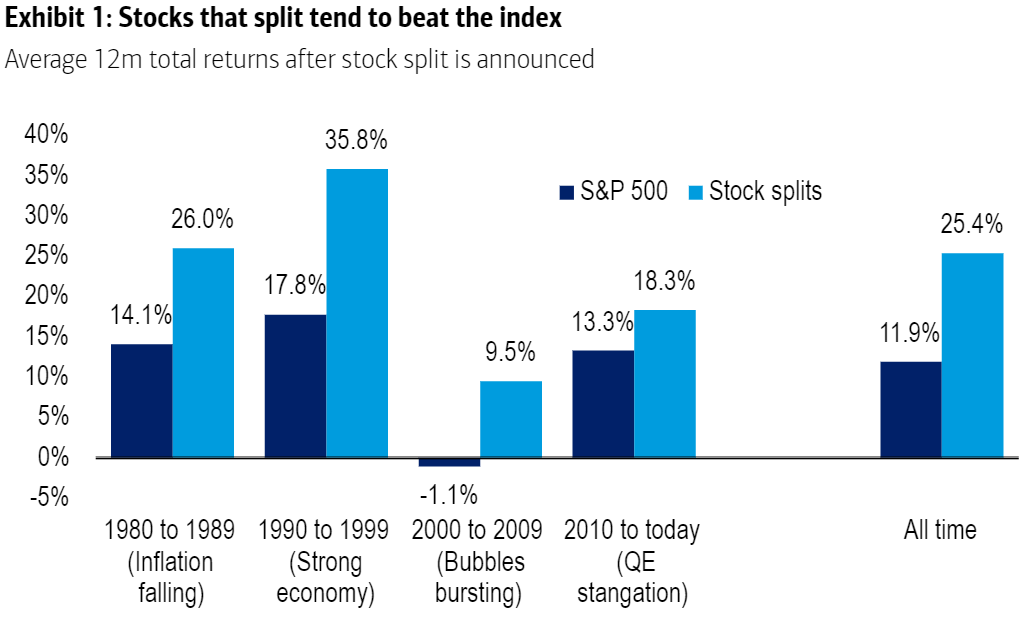

- Stock splits…one chart that we would like to highlight as we have received several questions regarding the recent Nvidia Corp. split. We would note that usually a stock splits because, in addition to a high stock price, the company has performed very well fundamentally, so a bulk of the continued performance likely has to do with continued fundamental momentum.

Source: Bank of America Merrill lynch

- Apparel retailers are discovering that weight loss is their gain. While blockbuster drugs like Ozempic that lead to significant weight loss have dented demand for diet plans and caused food companies to prepare for people eating less, clothing sellers are finding that millions of slimmed-down Americans want to buy new clothes. – Wall Street Journal

- Novo Nordisk A/S plans to invest $4.1 billion in another US factory, plowing more money into its biggest market amid rising discontent over the cost of its obesity and diabetes drugs. The project in Clayton, North Carolina, will double the company’s production footprint in the US, adding 1.4 million square feet of space for the final stages of manufacturing in which Novo’s medicines are filled into injector pens and prepared for consumers. – Bloomberg

In summary, while the S&P 500 continues to grind higher, the breadth of the rally continues to be somewhat narrow. With some weaker datapoints starting to surface in the consumer (we mentioned retail and restaurants in the past), housing prices flattening and employment finally showing some signs of weakening, the market may be due for a pause until there is further clarity around what may become a somewhat chaotic election season in the fall. However, these weakening economic datapoints may allow the Fed to start reducing rates, thus potentially dampening any significant weakness in the overall market.

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.