Mother Nature, Easter and Stock Pickers vs. Groundhogs

Happy belated Easter to all and we hope everyone is okay from the surprise earthquake that only Californians have really come to expect last Friday. With spring technically here and Easter just behind us, it brings to question one of the most famous prognosticators of the last century. No, not Warren Buffet, but Punxsutawney Phil. Unfortunately, his track record is not quite as strong with only a 39% accuracy rate over the past 140 years. With that level of “success” it gives us stock pickers hope just yet!

The Market

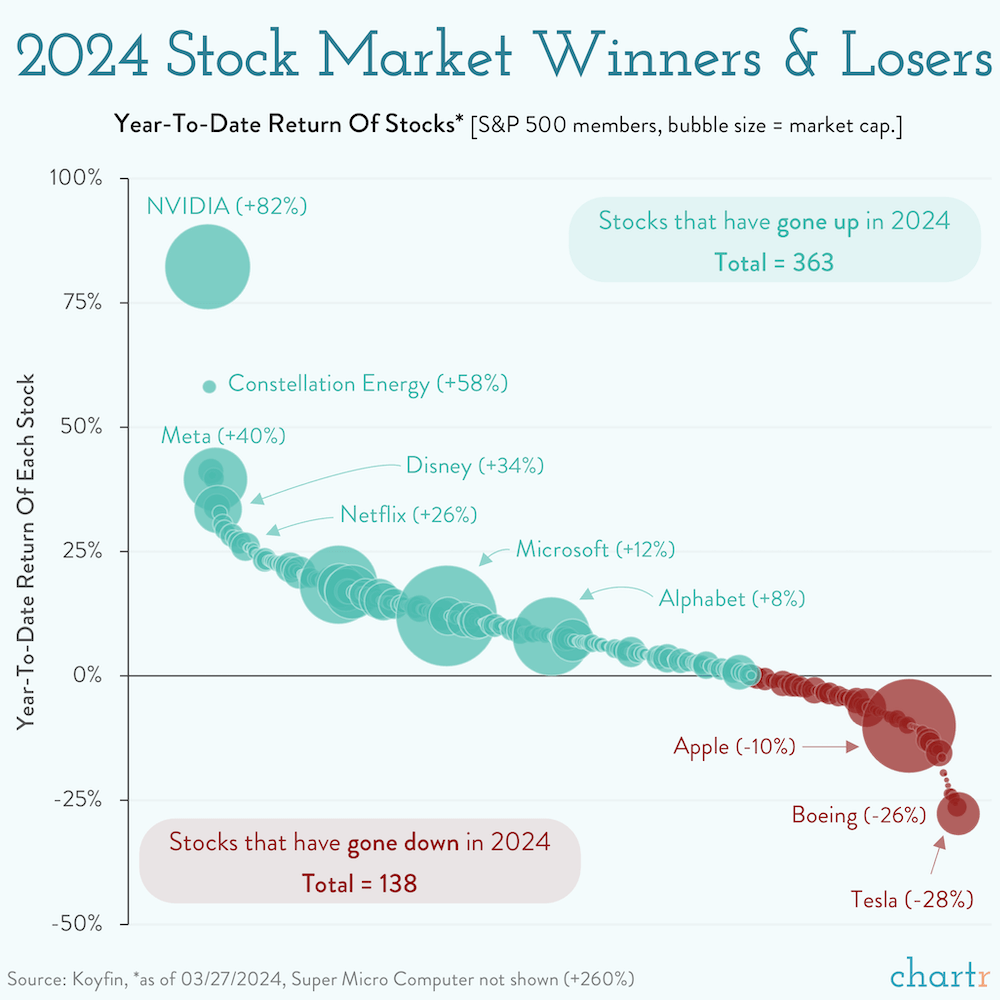

The broader market as defined by the S&P500 was up 10.2% in the 1Q of 2024, while the Dow was up 5.6%. This strength was mostly a continuation of what we saw in the 4Q of 2023 and was once again driven by the larger technology stocks that are associated with Artificial Intelligence (AI). While the Magnificent 7 continues to attract attention, this performance was more focused than previously and was primarily driven by Nvidia (NVDA) +88%, Meta Platforms (META) +42%, Microsoft (MSFT) +14% (Note: Tesla (TSLA) was -30%, and Apple (AAPL) -8%).

We expect that market rally to broaden to companies outside of the Magnificent 7 as interest rate cuts should have more of an impact on the more traditional cyclical growth companies and industrials.

Artificial Intelligence (AI)

Without a doubt, there is growth in this area of the market. The question now is whether actual growth can meet these high expectations. Consensus implies an AI server market of $166B in 2025, which is up from $20B in 2022. To frame this, the AI server market is expected to be 38% larger than the traditional server market in 2025 ($166B vs. ~$120B). While this is a massive departure from historical growth in the server market, which has grown at a CAGR of just 3% over the last 25 years, analysts seem to think this is possible based on addressable markets and real use cases. Since growth is never linear, and these are aggressive growth expectations, there may be an opportunity in the near to medium term, should there be a shortfall versus these very high expectations.

India – The “New” Frontier

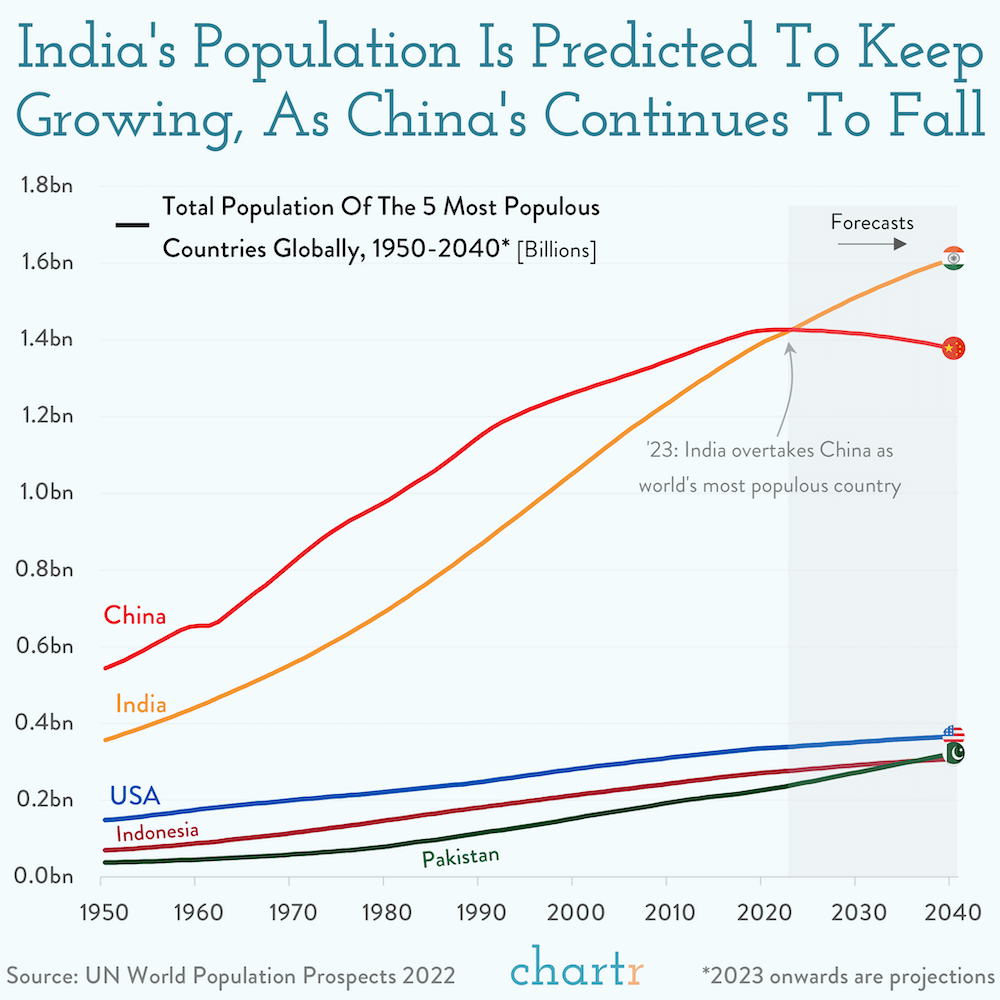

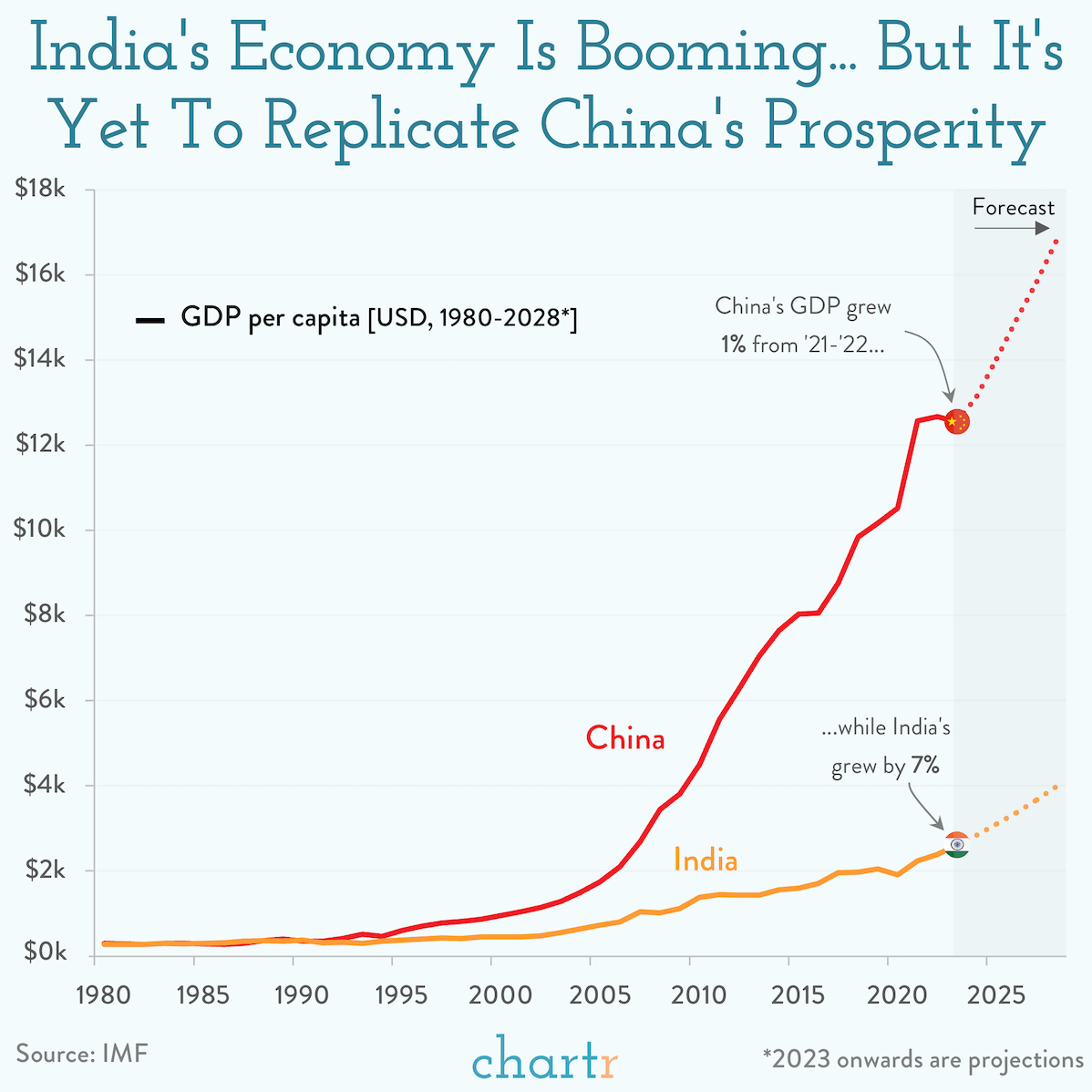

We have discussed India and the potential growth the country holds previously. The excitement is driven by the fact that it is the largest population, it is a young and growing population (unlike China, Japan and most of Europe) and that there is still a big gap to fill to get to levels of where China is on a GDP per capita basis.

Anecdotes and the Fed

Continuing from last month, here are several anecdotes and some updated Fed thinking:

- Darden Restaurants (DRI), owner of several well-known brands such as Olive Garden, Longhorn Steakhouse and Seasons 52, reported that lower income customers pulling away and eating more at home. This is consistent with what we were starting to see regarding inflation in food prices starting to recede (eating at home becoming cheaper than eating out). - Company Report

- Nike (NKE) and Ulta Beauty (ULTA) lowered earnings guidance. Both companies see weakness in future growth. While some of the concerns surrounding Nike (NKE) may be competitive in nature, the slowdown is also indicative of a weakening category and consumer. Ulta Beauty (ULTA) weakness was driven by both sales and margins which may be a harbinger for other retailers to come as the beauty category has been one of the stronger categories for growth in recent years. - Company Report

- China’s housing crisis is continuing to worsen despite the recent government interventions, with December new home prices in 70 major cities falling 1.24% Y/Y in January (vs. -0.89% in December) while secondhand prices sank even more. – WSJ

- Constrained on all sides, China’s central bank is aiming to squeeze more value out of its policy actions by catching markets unaware with surprise easing aimed at putting a floor under the struggling economy. A record cut to a key lending rate earlier this week announced by the People’s Bank of China was just the latest unexpected move since Governor Pan Gongsheng took office last summer. At a press briefing last month, he shocked with an outsized cut to banks’ reserve requirement ratio. – Bloomberg

With the Fed and the market now projecting three rate cuts for this year despite the recent strong employment data (which we have previously mentioned as lagging), we believe the market is now at an equilibrium where fundamentals will be the driver for further upside in the market. Interest rates staying “higher for longer” will allow investors to “lock-in” higher rates for their portfolios while the upcoming rate cut cycle should provide a potential buffer to any sharp sell-off in the overall stock market.

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.