Finding Calmness Amidst the Chaos…The Recent Selloff.

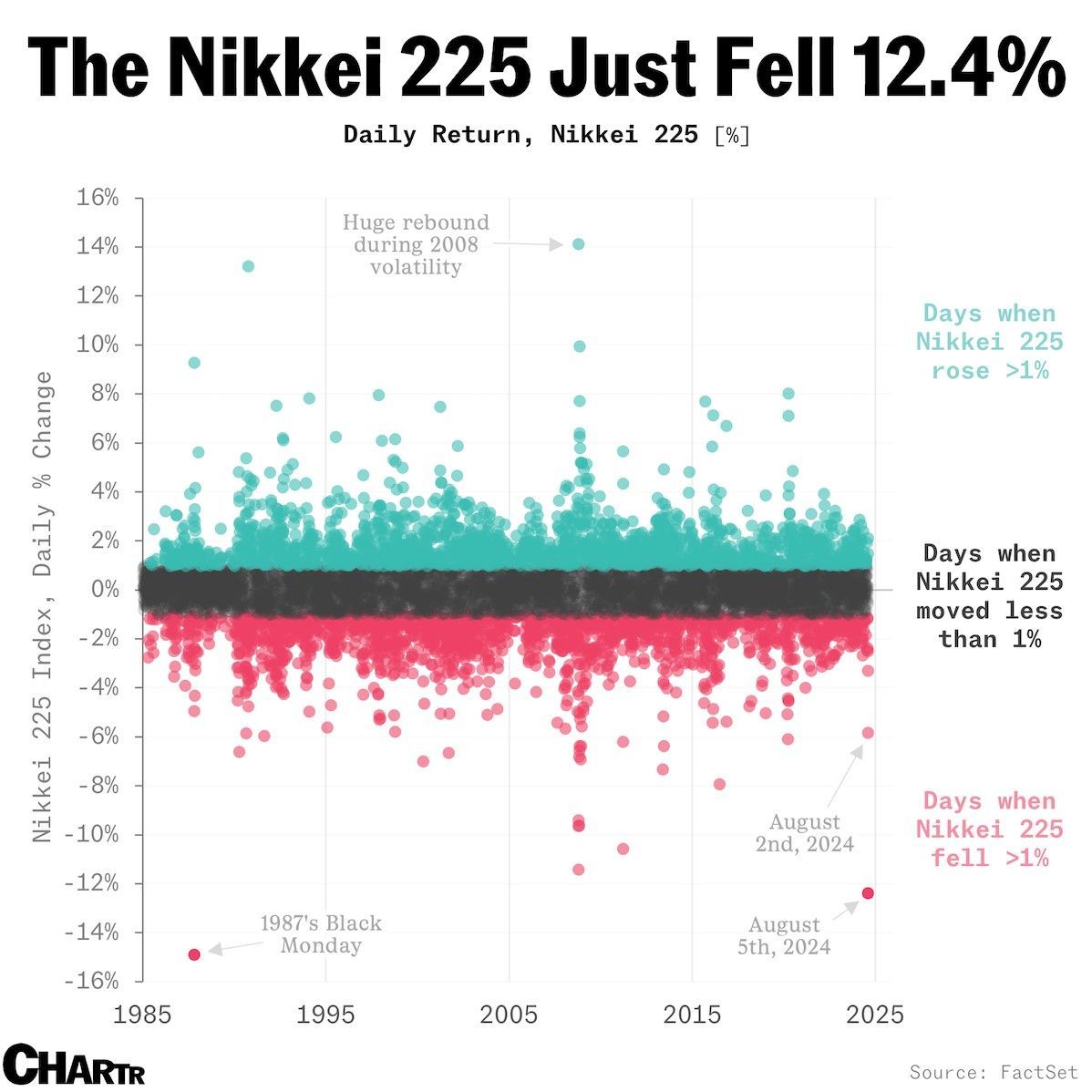

As I sat down on Sunday evening to begin writing the newsletter for August, markets in Asia were indicated down sharply. This morning, we woke up to the Nikkei doing this:

So why is this happening and what does this mean to US stocks?

Japan has for many years now had an extremely low interest rate relative to every country in the world. Because of the low rates, investors would borrow in Japan and re-invest elsewhere to get better returns. This was known as the “carry trade.” Last week the Bank of Japan raised rates and it has caused some issues with regards to this trade as a rapid appreciation in the Japanese Yen against the US Dollar created losses and is forcing an unwind of this trade.

Additionally, while the Japanese economy has exhibited signs of breaking out of its multi-decade economic stagnation, the strong rally in the Japanese market to record highs through the first half of the year reflected hopes that have yet to be substantiated. The US and Japanese economies have not been tightly correlated for many years now, therefore we see little fundamental impact to US companies.

Prior to the recent sell off, the S&P 500 and Nasdaq were up significantly year to date, so it is understandable as to why stocks would sell off as, combined with some recent soft economic data from the US, the markets were set up for some near-term profit taking.

Is the Fed behind the curve? The dreaded “R”-word.

We have always been focused on fundamentals and valuations to determine the potential opportunities in companies or the overall market. While there has been a lot of news around a weaker consumer, a weaker employment report and a weaker ISM report, we are nowhere near “Recession” territory versus some of the expectations 12 months ago. In fact, these weaknesses are exactly what is needed for the Fed to stop raising interest rates and start reducing them. The magnitudes of the negatives are somewhat benign and the main growth driver, Artificial Intelligence/Technology, remains intact as Microsoft, Alphabet and Amazon provided strong cloud outlooks on their calls in the past couple weeks.

In summary, while the economy has shown some signs of finally slowing, this will enable the Fed to start reducing rates and should ultimately provide a floor to the stock market. We will continue to monitor the elections and will have more discussion on that in our monthly newsletter next week. Finally, we do not feel the Fed will cut rates in the interim prior to the next FOMC meeting on 9/18, but there will be plenty of opportunity for Fed officials to make “calming” remarks between now and then with the Jackson Hole Economic Policy Symposium on 8/22-8/24, where Chairman Powell will also have the opportunity to calm markets if necessary.