Happy Holidays!

First, we hope everyone had a safe and happy Thanksgiving! As we near the end of the year, this will be our final newsletter as we are scheduling year-end review calls and should be speaking with each of you again shortly. If you have not scheduled the call, please contact us as soon as possible.

The Magnificent Seven vs The Mediocre Market.

We have in the past talked about concentration of the market and how the market is not necessarily a good indicator of the overall health of the market. While last year did show some indications of this, the performance in 2023 was defined by this. Most of us have by now have heard the references to the “Magnificent 7.” It is, more or less, the largest seven companies by market cap in the S&P 500 (sometimes Berkshire Hathaway (BRK.B) ranks 7 th ). The companies in this group are Apple Inc. (AAPL), Microsoft Corporation (MSFT), Alphabet Inc. (GOOG), Amazon.com, Inc. (AMZN), NVIDIA Corporation (NVDA), Meta Platforms, Inc. (META) and Tesla, Inc. (TSLA).

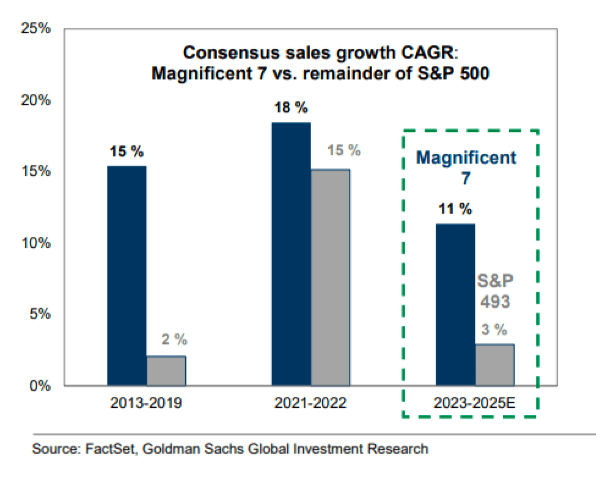

From the charts below, which run through mid-November, we highlight 2 things…

First, the seven largest companies make up nearly 29% of the overall market, the highest in 40+ years. This is important to note not only from a performance concentration standpoint, but also in terms of consideration of how undiversified some portfolios may actually be. This concentration is even more pronounced in growth indices, such as the Russell 1000 Growth.

Second, the chart on the right shows the returns of the Magnificent 7 indexed at 71% versus the remaining 493 companies in the S&P 500 at 6%, which skews the S&P 500 significantly to be +19%.

Finally, on this point, something a little more forward looking…

As can be seen from this, growth prior to COVID was mostly driven by these companies. Post-COVID, sales growth for the broader market (the other 493 stocks) recovered, but going forward is now expected to be minimal. This gap is even more pronounced when analyzing profitability of the companies, as the Magnificent 7 generally have very high gross margins and an ability to lay off employees with minimal impact to revenue, thus showing greater earnings leverage to cost cuts.

Interest Rates.

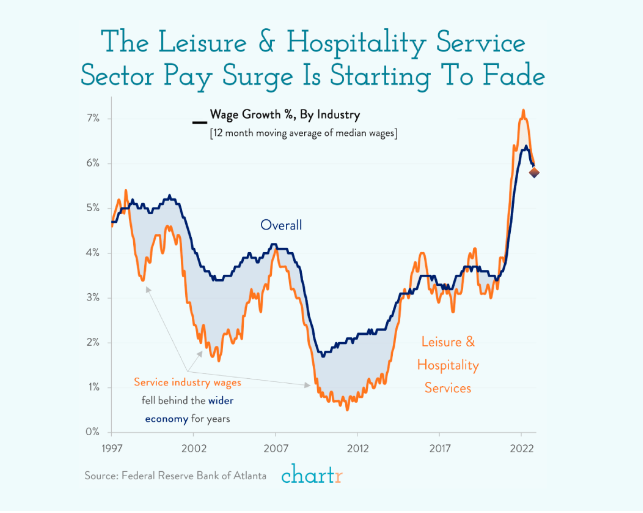

While still second on the list, the recent decline in rates off highs has provided some relief to the capital markets. Additionally, we continue to see signs of slowing inflation (not quite at the 2% goal yet), weakness in the consumer (weak earnings report) and most importantly, weakness in the employment market. Banks have been continuing to lay off employees as Citibank and Morgan Stanley had very low profile 10% workforce reductions lately, and we are also seeing wage growth slow (as can be seen from the chart below).

This bodes well for the end of the tightening cycle and the focus moving forward will now be when and how fast will the Fed cut interest rates.

China.

It has never been clear as to the quality of the government data that is reported. While it has been negative over the last several quarters, the outlook going forward is “stable at best.” While we have talked about the high rates of youth unemployment and poor demographics/shrinking population as long-term secular concerns, the government has been long working on cleaning up the financial system and technology sector with moderate success. Continued bailouts and stimulus probably put a floor on the negativity in the near-term as does the hopes of some potential thawing of relations between the US and China.

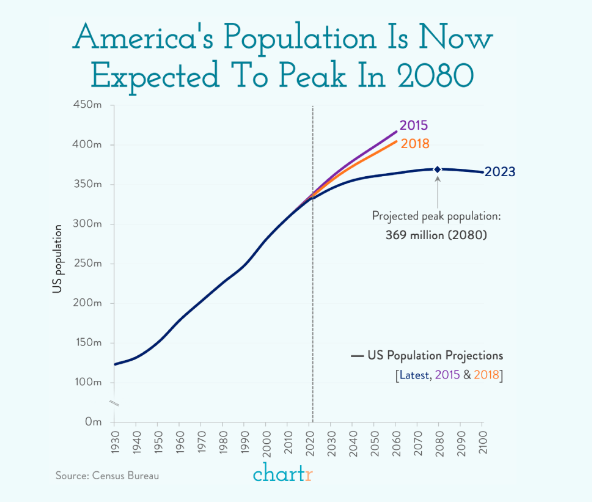

US Population.

This was an interesting chart we came across. While a peak in population is still quite a ways out and likely beyond my lifetime, what was interesting about it is the flattening of the curve within many of our investable time horizons.

While the strength in the market this year has been driven by only a handful of stocks, it has been better to own index funds over mutual funds as many active managers that have diversified portfolios will have found it very difficult to outperform the broader indices given the construction of those indices. The projected growth for the Magnificent 7 over the next several years seems to support the optimism with valuations not being overly excessive. However, if the broader market does not strengthen, and in fact continues to weaken, there will be some risk to those names as expectations are high, therefore we continue to be conservative and take advantage of the higher interest rate environment and the opportunity that exists in fixed income investments when the Fed eventually cuts rates.

We would like to thank all our clients and followers for your continued support. We wish you all a safe, healthy and happy holiday season, and a prosperous New Year and look forward to connecting over the next several weeks. Cheers!

Important Disclosures

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.