A Collection of Market Thoughts.

The market has been roughly flat for the past month despite another large bank, First Republic, having to be seized by the FDIC and subsequently purchased by JPMorgan Chase & Co. This continues some of what we saw last month where, despite some of the turbulence, on the surface, things look calm. The VIX, which is a popular measure of volatility, is usually a good contra-indicator. It signals the level of fear or stress in the market and is sometimes known as the ”Fear Index.” It is currently trading at pre-pandemic levels despite a Russian invasion of Ukraine, unprecedented Fed tightening, bank runs, debt ceiling concerns and of course a possible recession. So where does that put us now?

Debt Ceiling.

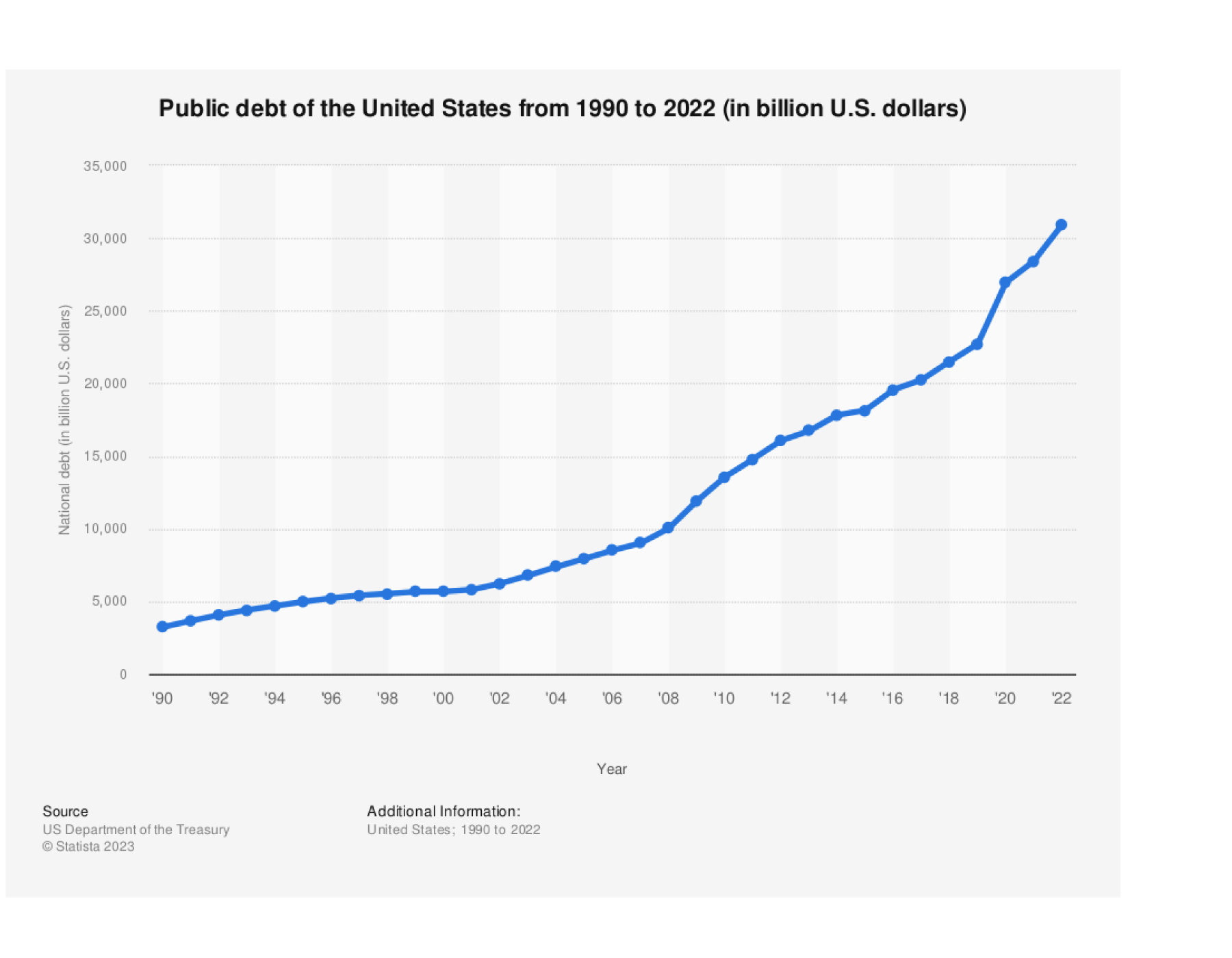

A red herring is defined as something that is intended to distract attention from the real problem. The debt “fight” itself with the somewhat “artificial” deadline of June 1 st in our mind is somewhat of a red herring. As of this newsletter, the US deficit is nearing $32T. While both sides will continue to posture, the likely outcome is that the limit will be increased another 1, maybe 2 years. The real issue is that at the end of this extension period it will then be around $35T and nothing will have been done to stop the increase in deficit spending.

This is a much longer term problem for the country, as it becomes more and more expensive to service this debt, and that will reduce GDP growth which will have a true impact to upcoming generations.

Recession and the Markets.

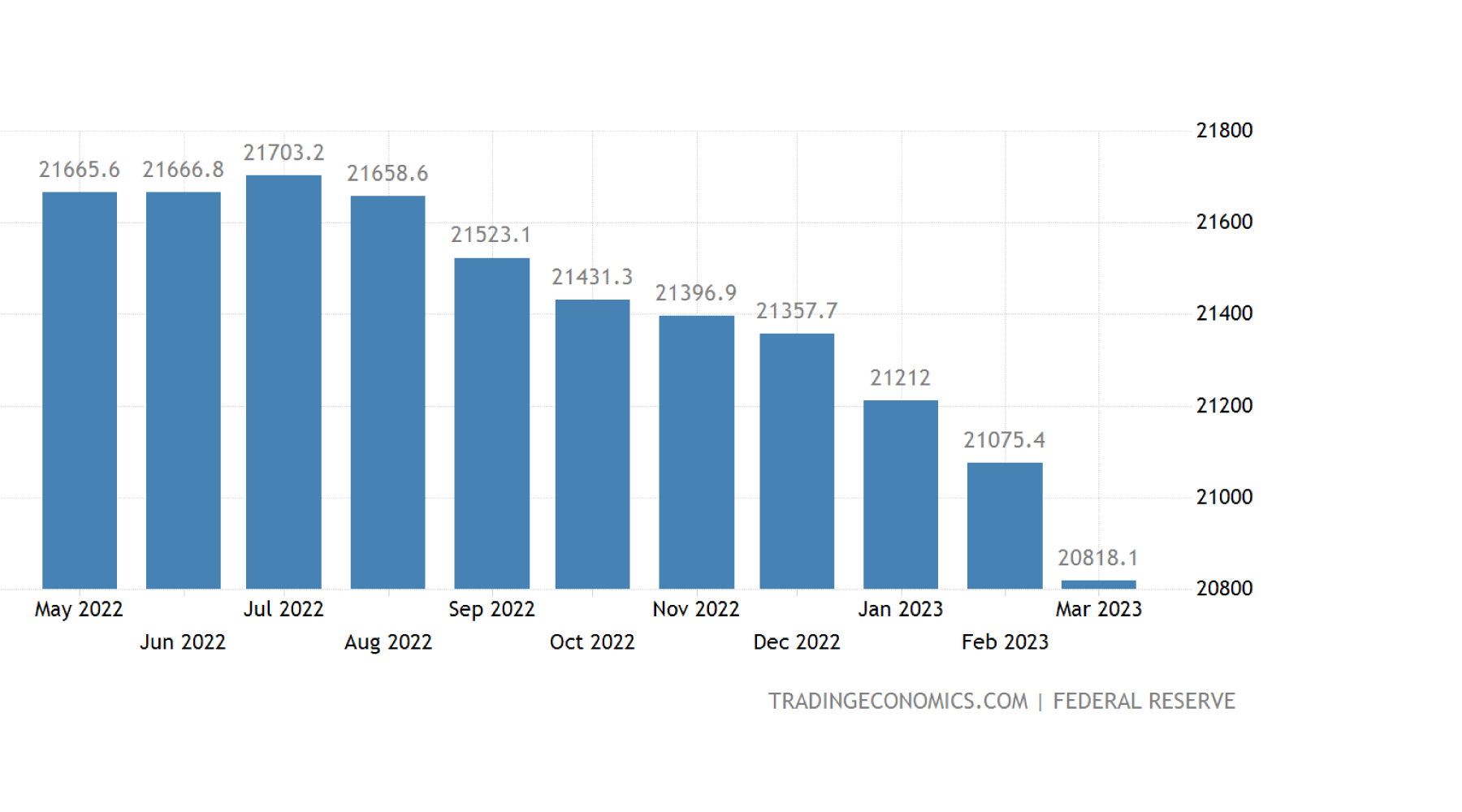

M2 is the measure of liquidity in the markets. Historically, when we have seen this drop as significantly as the chart below shows, we have gone into a recession.

Additionally, the Home Depot report supports these concerns as two out of the three reasons cited for the weakness are pretty broad based, namely, deflation in certain products and a broad-based moderation in demand through the quarter. Walmart and Target followed suit and also gave weaker outlooks supportive of the expected weakness in the economy through the balance of the year.

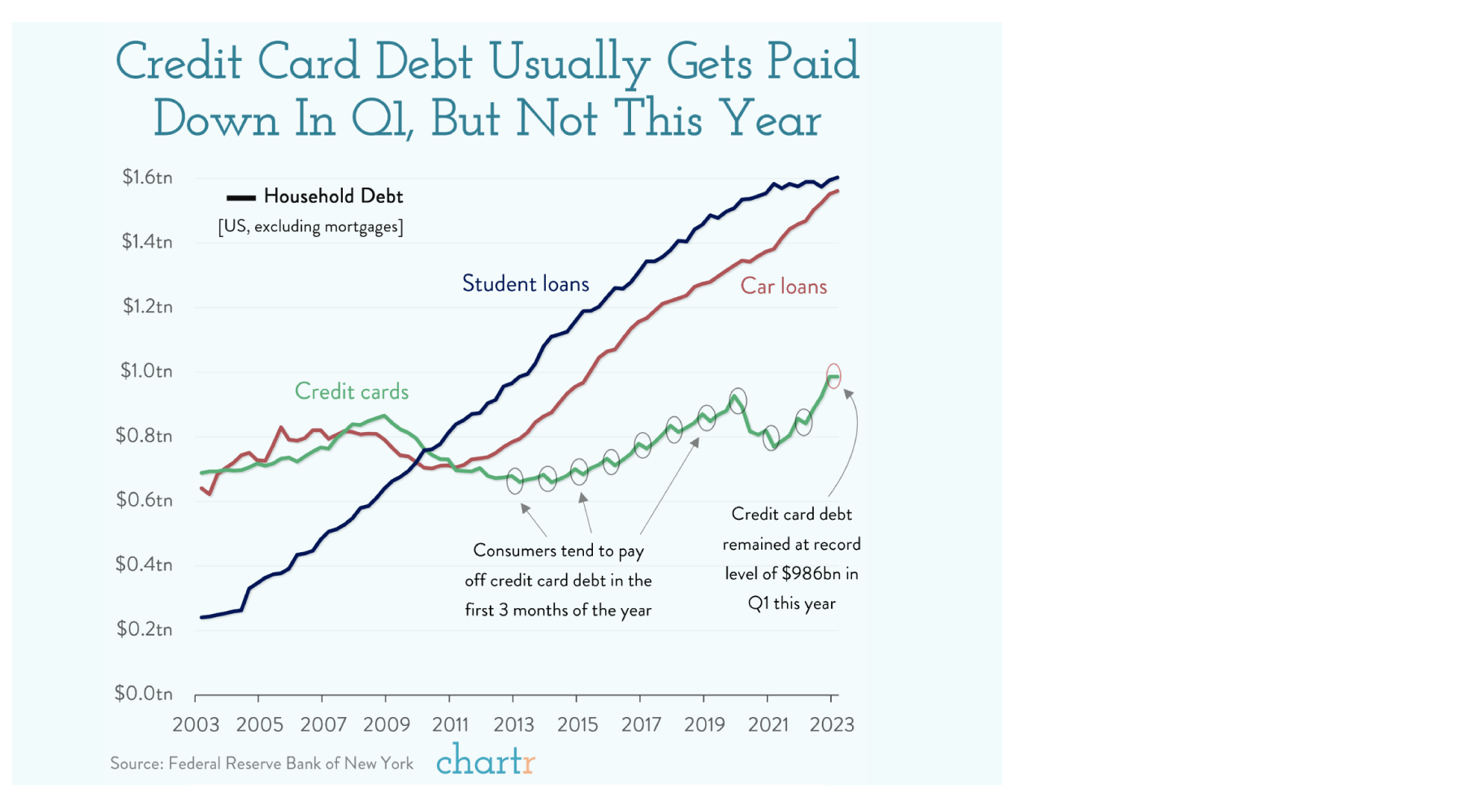

The weakness in the consumer at the lower end is evident and is also shown in the chart below…

While inflation has helped the top line as companies across most industries and sectors were able to raise prices to help offset margin pressure they experienced, we think as inflation cools it will not only hurt top line as prices level off, but also impact margins as they will not be able to reduce costs quickly enough due to labor costs remaining stubbornly high.

Technology/AI.

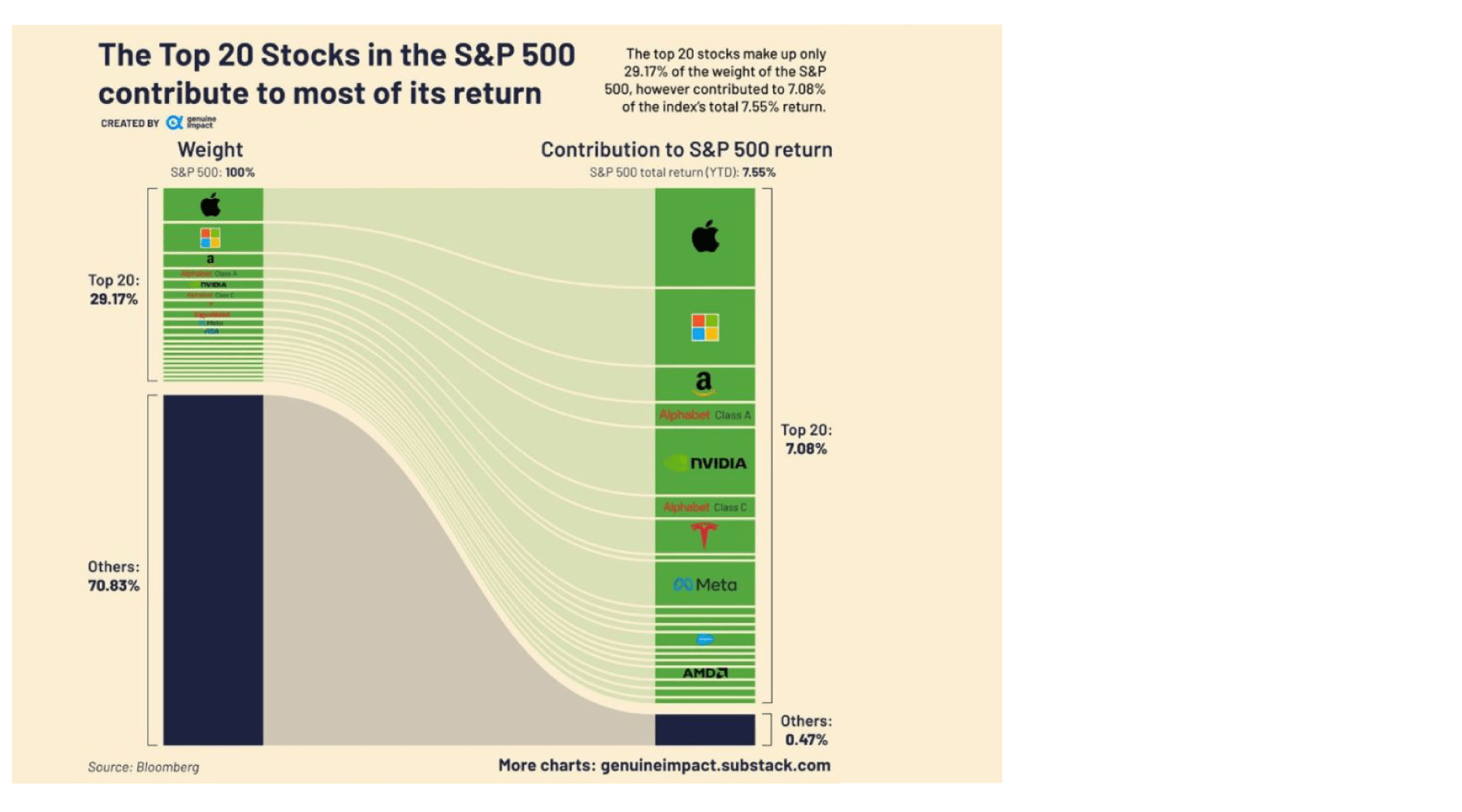

We have often discussed trying to identify growth sectors as potential areas for investment for the longer term in sectors and for the market in general. One area over the past several quarters that has garnered a lot of attention is Generative Artificial Intelligence (AI). We briefly mentioned ChatGPT previously, and it has become more popular than we expected in a very short period of time as many companies have embraced AI as it is potentially a way to increase operating efficiency for certain tasks, and ultimately can help drive down costs. In these early stages, however, the leaders are larger technology companies and through late April, this chart supports a recurring theme about the concentration of returns being tied to a minority number of companies in the market.

We continue to monitor for additional companies that will be beneficiaries of this trend as we believe it will ultimately transform our everyday lives the way wireless technologies and the internet did. We assure you though, we will continue to write these newsletters and communicate personally and not use ChatGPT to do so.

Financials.

With the “last shoe to drop” with First Republic no longer an independent entity, there should be no additional significant issues regarding bank runs and regional banks due to investment duration imbalances. There will however be lower loan growth as lending standards tighten. One interesting anecdote is Elon Musk warning about slowing growth in upcoming quarters as auto lenders pull back loans. As we mentioned in the previous newsletter, investors also continue to focus on commercial real estate (CRE). With $1.5T US CRE debt coming due in 2025, the area of concern is in low investment grade companies since refinancing at higher rates has the potential to significantly impact earnings at a time when the economy could be in recession. The other concern for CRE and other non-publicly traded assets is what the companies are valuing them on their books as pricing is not always reflective of their true value.

What Does All This Tell Us?

While the market has been somewhat passive with regards to the negative headlines, there is reason to not be overly negative. Many companies have been cutting costs (layoffs and corporates expenses/investments) which provides support to earnings and profitability and thus can help keep market multiples intact. Most importantly, whether it’s later this year, or more likely in 2024, the Fed now has many opportunities to CUT rates and stimulate growth should the economy slow and go into recession and since the market is generally very forward looking and anticipatory, this should mitigate significant downside.

Important Disclosures

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.