Get Connected

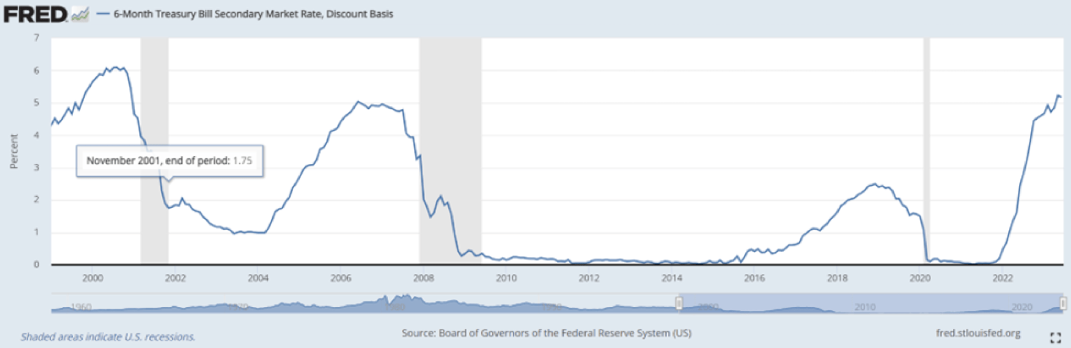

Take Advantage of Highest Interest Rates in More Than a Decade.

Financial advisors typically advise clients to hold enough money in an emergency fund to cover 3-to-6 months of household living expenses, and in some cases emergency funds are set up to cover a year’s expenses. Unknowingly, many families are keeping these funds in checking accounts, which typically pay very-little-to-no interest. In today’s high interest rate environment, these funds can be earning thousands of dollars more annually in interest, while not taking on any additional risk. Here are three sensible options:

1. Buy Short-Term Treasury Bills.

Short-term treasuries, backed by the full faith of the US Federal government, are a very attractive investment – they currently yield slightly more than 5% and interest is not taxed on the state level, which would benefit residents in states such as California, New York, New Jersey and many others. Additionally, short-term treasuries are fairly easily purchased in a brokerage account or a TreasuryDirect account. However, holders of these bills have to be vigilant in reinvesting the money upon maturity. A way to eliminate the need to closely monitor maturities would be to invest in a short-term treasury ETF, such as BIL (SPDR® Blmbg 1-3 Mth T-Bill ETF), but note these investments carry fees (BIL fee = 13.5bp).

2. Move Funds to a High-Yield Online Savings Account.

These accounts are FDIC insured up to $250,000 per depositor and right now, the best high-yield accounts have rates approaching 5%. Be sure to check the account’s minimum deposit and ongoing balance required and if there are any ongoing account maintenance or other fees. These accounts may also have a limit on the number of times that you can move or withdraw money each month. However, if this is your emergency fund, you should not be touching it often.

3. Purchase a Money Market Mutual Fund.

Money market mutual funds typically invest in very short-term (often overnight) maturity debt securities of investment-grade companies, and thus are minimal credit risk, low-volatility investments despite not being insured by the government. Many top brokerage companies – e.g. Fidelity, Vanguard, Schwab, offer money market mutual funds which have very large diversified portfolios (> $50 billion) and currently yields nearly 5%.

Important Disclosures

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use