Get Connected

Tariffs…Some Thoughts to Consider

“You keep using that word. I do not think it means what you think it means.”

My favorite movie is “The Princess Bride.” The quote above is from the scene where Vizzini uses the word “Inconceivable” one too many times with Inigo Montoya and Fezzik on what is ironically the “Cliffs of Insanity.” As I am writing this, S&P 500 futures are indicated down another 5% and it feels like we are “on location.”

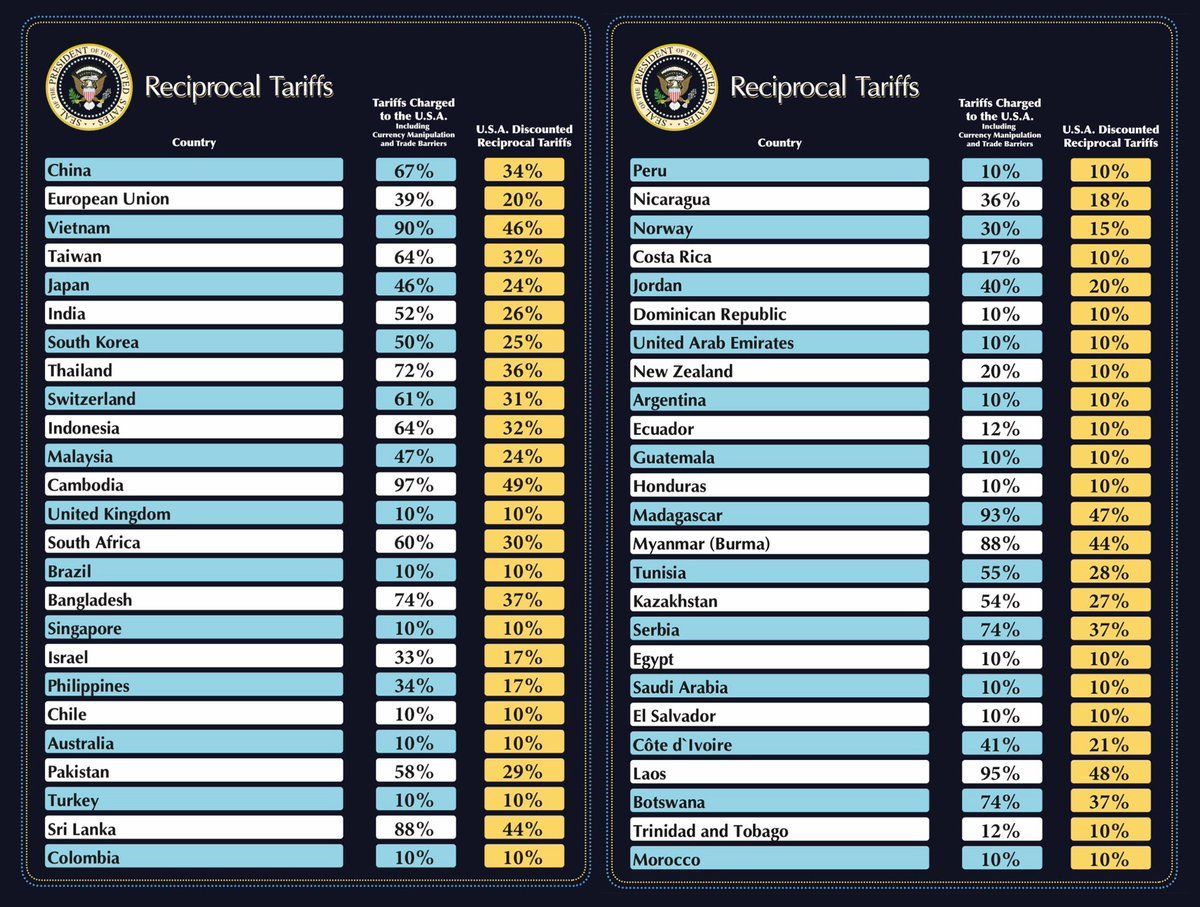

The Issue: “Reciprocal” Tariffs

While there are multiple definitions for the word “reciprocal” it can mean “operating for both, especially or equally to a similar degree”; or it can be the inverse/opposite…usually it is used to describe something that is similar on both sides.

Source: whitehouse.gov

What has caught investors off-guard is how the tariffs were calculated. The calculation is on 2024 good-trade deficit with a country, divided by the amount the US imported from that country. That result was then divided by 2, which is the “Discounted Reciprocal Tariff.”

So, taking China for example, our trade deficit with them in 2024 was approximately $295b, which divided by the amount the US imported from there, which is 67%. Then, divide that by 2, and you get the 34% the administration calculates as the reciprocal tariff. This will then be on top of the earlier tariffs on China that were announced.

If that does not really make sense as to how it was derived, not to worry, you are not alone.

Recent events...

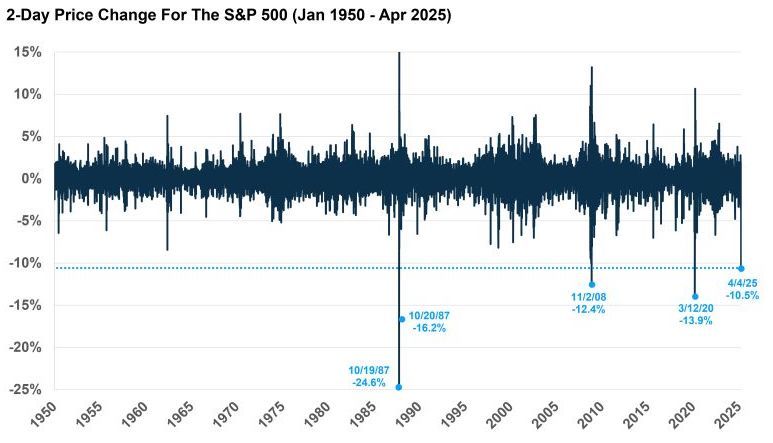

This is one of the worst two-day selloffs in the past 75 years, with the others being the crash in 1987, the selloff in 2008 during the Great Financial Crisis, and during COVID.

Source: Bloomberg

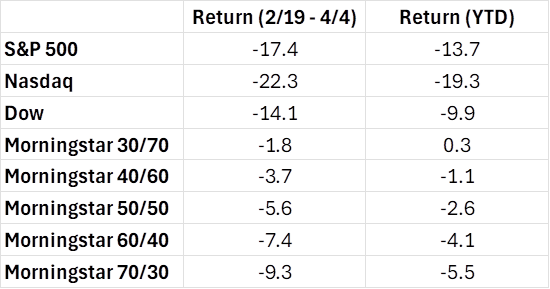

…while the various indices and style buckets based off Morningstar from the highs and year-to-date are as follows:

Things to consider…

Diversification. Unlike 2022 where bonds declined because of increasing yields, bond yields have declined which has served as an offset to the weakness in equities year to date. Additionally, exposure to non-correlated investments is potentially a good option.

Liquidity. The timing of cash withdrawals and what is being sold to fund those withdrawals is important to consider.

Interest Rates. Part of the thought is that the President would like the Fed to cut rates to reduce the amount of interest we are paying on debt. The Fed being able to cut rates has long been a “put” in our overall thesis of sharp market declines not being sustainable for a long period of time. The one caveat to this now is that, if the tariffs are in fact inflationary, it will pose a challenge for the Fed to cut rates aggressively.

In Summary…

While a fix (recovery) is unlikely to happen as quickly as this damage was done, within 24 hours of the tariff announcement and the market selling off, Vietnam and Cambodia were very quickly negotiating a way to resolve this. It is always difficult to time markets, but after crises, the market has eventually recovered, often aided by a low interest rate environment and usually with focus on industries or sectors that have long term sustainable growth drivers.

One of my other favorite movies is “My Best Friend’s Wedding” and the quote from that movie that always resonates with me is “this too shall pass.”

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use