Get Connected

"Stagflation and Tariffs and Bears! Oh, My!"

“Stagflation and Tariffs and Bears! Oh, My!”

In the Wizard of Oz, when Dorothy, the Scarecrow and the Tin Man are venturing into the dark forest, they discuss what types of animals they might encounter. In fearing this unknown danger, they start singing “Lions and Tigers and Bears! Oh My!”

This fear of the unknown has investors and markets a bit on edge as of late, given the aggressive and unorthodox approach the new administration has been utilizing to carry out promises made during the campaign. We will try to address some of these concerns and, as always, emphasize the long-term view and more of a focus on growth fundamentals, as the market ultimately returns to that.

Concerns.

#1 Stagflation. The Wikipedia definition of Stagflation is the combination of high inflation, stagnant economic growth and elevated unemployment.

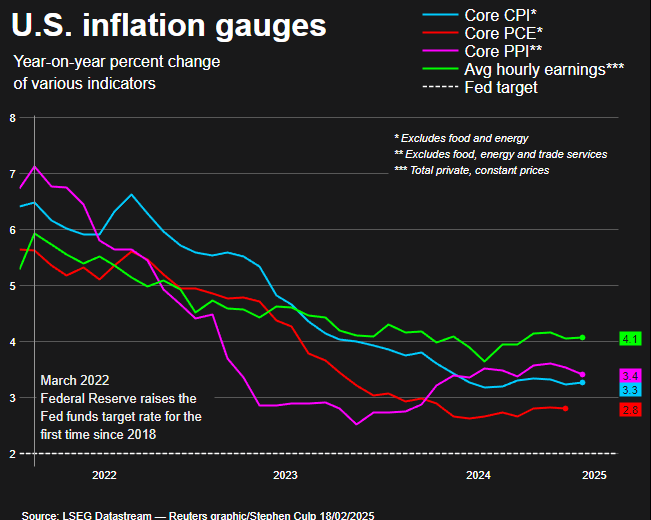

While in the very near term, the concerns about tariffs driving prices higher may be valid and the headlines around egg prices due to bird flu are pushing prices higher, there are more prices actually on the decline which we expect to continue, such as gasoline prices, consumer technology, used cars, eating away from home (fast casual and restaurants), clothing, toys and many other food items.

Stagnant economic growth is highly unlikely over the next several years. Again, while there may be a short-term “blip” because of what is going on in government spending because of DOGE freezes and cuts, the long-term growth drivers of Artificial Intelligence (AI) and continuing demographic/wealth shifts in the world are too strong for any sustainable declines.

Elevated unemployment is the one longer term area of concern. DOGE cuts will likely cause an increase in unemployment in the short-term, as will the resetting of aggressive hiring at many companies during COVID. Once a new equilibrium is reached, the concern will be the long-term impact to some higher paying services jobs due to the rapid implementation of AI.

#2 Tariffs. Bluster or a real risk? What is being discussed and what is being implemented seems to vary day to day. The threat is a 25% tariff on imports from Canada and Mexico, and a 10% additional tariff on imports from China. If fully implemented for a prolonged period, these would most likely be damaging to the economy initially and potentially reignite inflation which could create a dilemma for the Fed. That being said, the tariffs are most likely being used as a threat (President Trump has said this as well) to bring countries to the negotiating table. We continue to monitor the situation, but, for now, what the threat is causing is pauses in spending from both the corporate sector as well as the consumer sector.

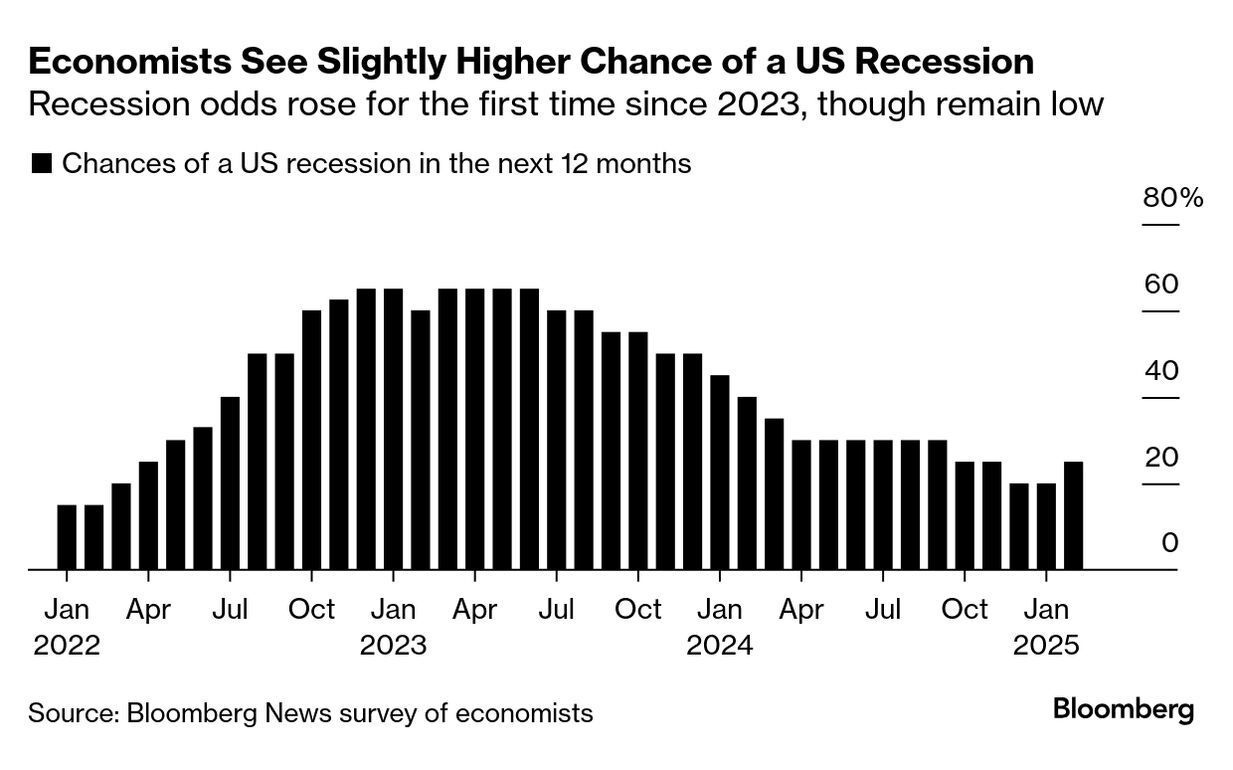

#3 Bears. Back in July of 2022, the 10-year/2-year yield curve inverted for the first time in this current economic cycle. Historically, this has been a reliable predictor for recession within 6 to 18 months. Instead, the S&P500 rallied approximately 50% amid no signs of a recession. Late last year, the yield curve steepened and now inverted again amidst fears that we are potentially going to have a recession. This whipsawing is causing pause in the market but continues to provide opportunities to lock in at higher rates for longer durations. One thing we are NOT confident about is that this inversion is going to be any more accurate a gauge of recession than the previous inversion.

Growth and Artificial Intelligence.

Since we last wrote about what is most likely the most important driver for economic growth, Artificial Intelligence (AI), there have been some high-profile events in the sector, namely, the release and rise of Chinese AI companies, starting with DeepSeek.

DeepSeek’s launch of its AI model made waves with the coupled assertions of better-than-OpenAI performance developed at a fraction of the cost, but further inspection of the DeepSeek model yields clear evidence that the Chinese researchers largely layered quite-sophisticated algorithms on top of OpenAI technology. The primary implications of this result are twofold – firstly, the entire AI community benefits from the innovative leaps of the Chinese technology which secondly, will actually drive adoption of the new AI reasoning models as they are incredibly expensive even with incorporation of enhanced algorithms. Nvidia’s CEO commented two weeks ago that it would take 100 times more computing power to support next-gen AI that can reason through problems.

In addition to the DeepSeek announcement, investors digested worrisome news regarding Microsoft cancellation of leases for datacenter capacity, which raised questions on whether long-term demand for AI services was overestimated. While the explanations of Microsoft’s AI partner OpenAI securing significant computing capacity through the newly announced Stargate venture with Oracle and SoftBank and significant new commitments to AI buildouts from sovereign governments (e.g. France, South Korea, with more to come) are plausible, it is clear that the successful rollout of AI agents that perform tasks on users’ behalf will be necessary to justify the continued high investments in AI.

Sempra, a large utility with operations primarily in California and Texas, recently gave an insightful perspective on the long-tailed nature of the growth opportunity of the “electron economy”, with AI buildouts as the central driver, “Today, we’re announcing another record five-year capital plan, totaling $36 billion, an increase of 50% over the five-year plan we announced last February. Oncor’s investments over 2025 through 2029 are expected to support diverse growth across our service territory as the region continues to exhibit strong annual premise growth in the 2% range, receive a growing number of interconnection requests from large C&I customers, while remaining a highly desired destination for both business and residential customers to the state. When we look farther out, we believe our growth continues well into the next decade. If current growth trends continue, we estimate investment in our system requiring $55 billion to $75 billion from 2030 to 2034.”

Anecdotes

- “We expect Palantir (PLTR) to generate $20b in EBITDA by 2035” (this implies 25% revenue CAGR and 57% EBITDA margins) – BofA Global Research

- Revolving credit card balances are $650b, a new decade high. Previous high was ~$550b during COVID with a low of ~$425b in 2021 – Federal Reserve Bank of Philadelphia

- Amazon finally surpassed Walmart in sales – Bloomberg

Conclusions.

While inflation has not declined as quickly as some have hoped, we believe it is on the right trajectory. Job growth has slowed and should continue to, and housing sales have also slowed with prices now leveling off, which we believe should allow the Fed to eventually get back on the path to lowering interest rates which should minimize the overall weakness in the market.

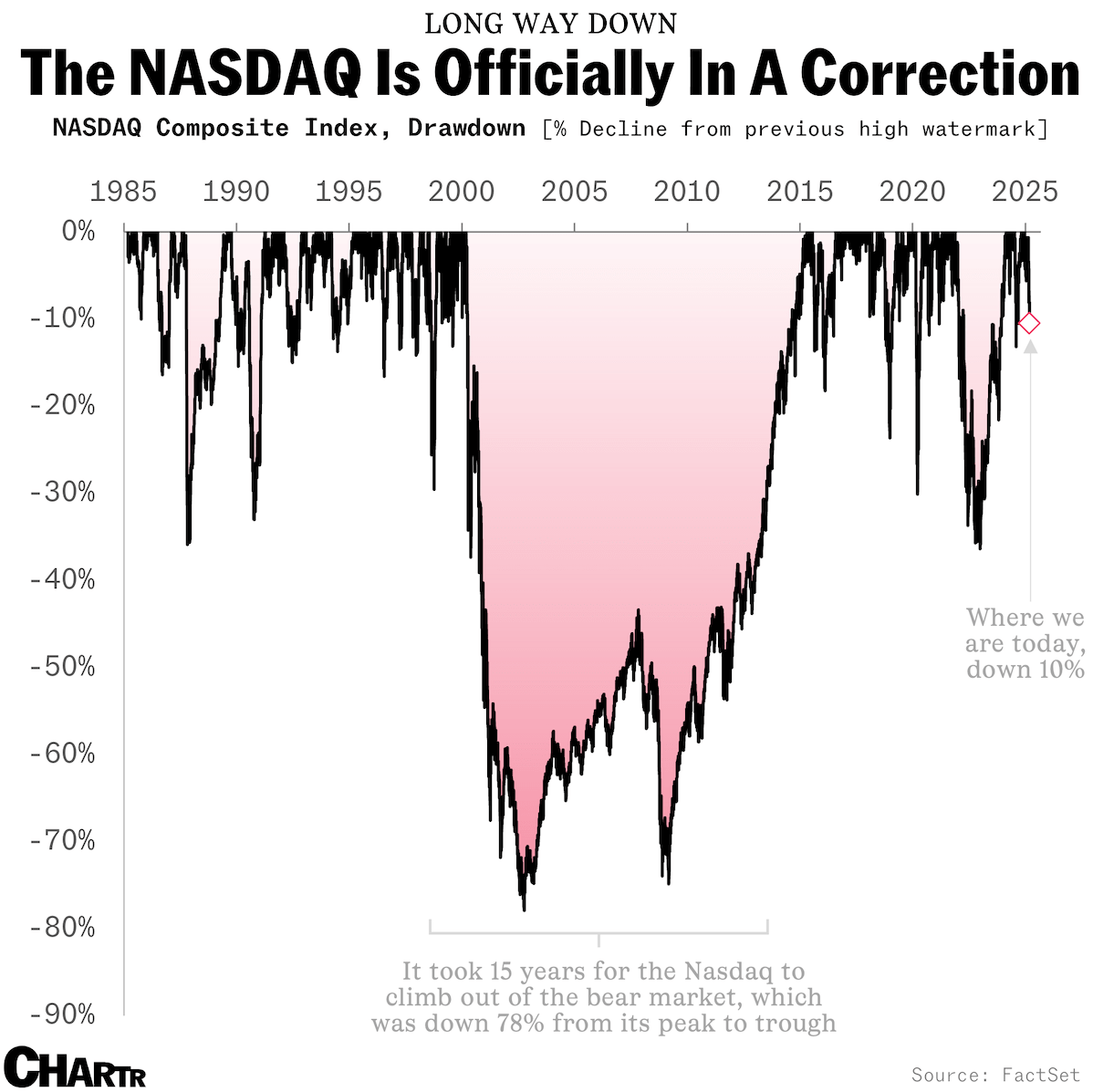

With the Nasdaq now officially in correction territory (-10% off highs)…

…and after two strong years in the market the S&P 500 is nearly 6% off recent highs, and down approximately 1.7% YTD (as of March 7, 2025), there are now some opportunities in high quality companies.

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of

great companies with great management at good prices.” - Warren Buffett

The recent slowdown in economic activity would usually allow the Fed to loosen monetary policy, however, the uncertainty around tariffs (and hence inflation) has kept the Fed on pause. As the year progresses and investors get more visibility regarding the impacts of tariffs, DOGE and the geopolitical situation, the long-term growth drivers remain in place and we eventually expect the Fed to cut and the market to rally more broadly, though at more modest rates than the past two years. This continues to make the fixed income opportunity attractive as we expect the current yield, plus potential upside in the underlying value of the bond to be more similar to that of the broader equity markets this year.

DISCLOSURES

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. This communication is confidential and may not be reproduced without prior written permission from Bergamot. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use