Summer Afternoon.

With the arrival of June, we welcome summer. Two other words that do not sound so bad to investors are “positive markets.” As of Friday, the S&P 500 is up roughly 14% year-to-date which brings it approximately 9% off the all-time highs seen in early 2022. During the market decline in 2022, we wrote several times about how the underlying stocks in the market were significantly worse than the overall market appeared. Once again, the performance in the S&P 500 is deceiving.

Market Concentration.

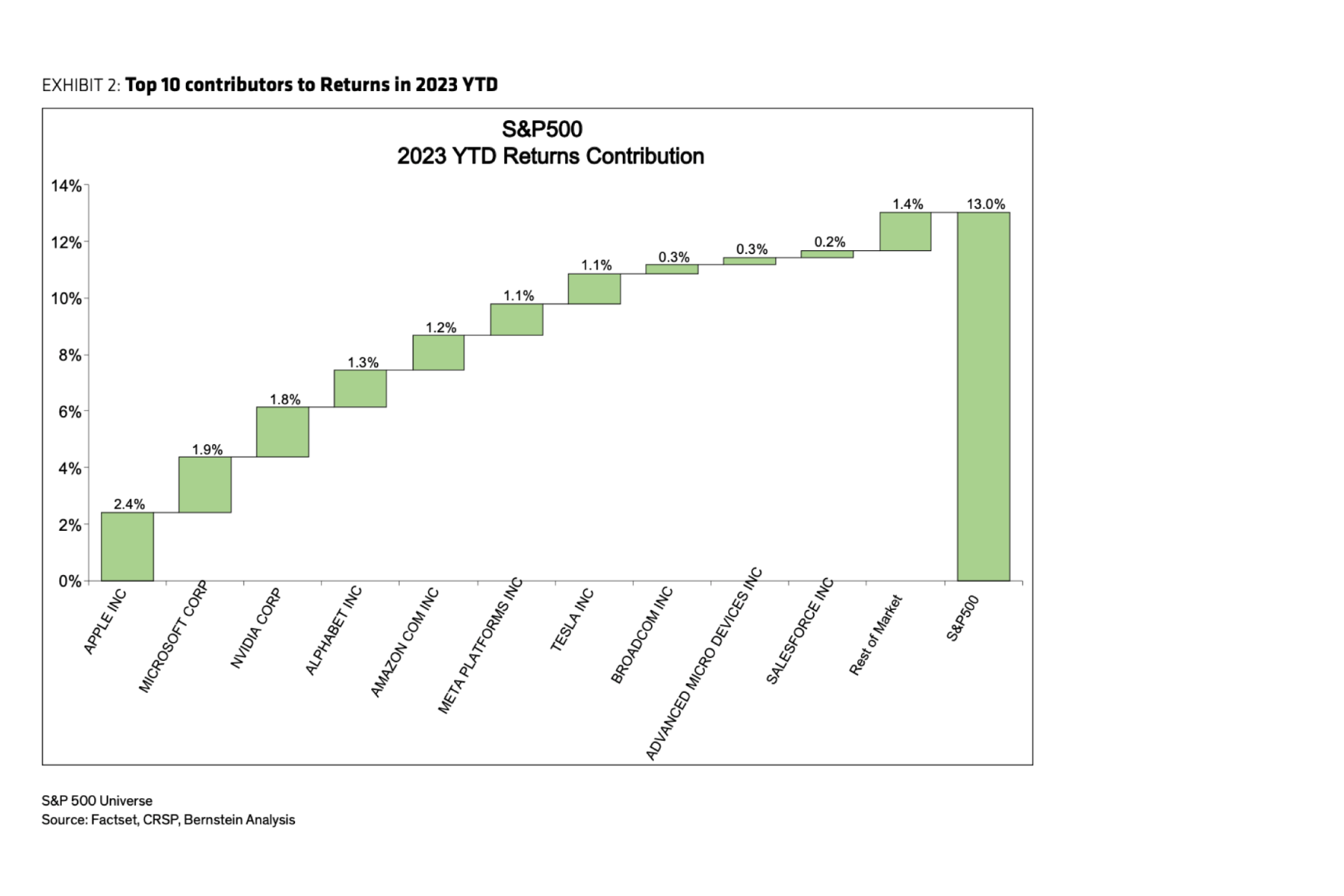

Much is usually written about portfolio diversification. It is still a very important tool in balancing risk and reward and helping investors reach their long-term goals. As seen in the table below, the top 10 contributors (through mid-June) accounted for nearly 90% of the S&P 500’s year-to-date return, while the remaining, roughly 490 stocks contributed a measly 1.4%. This has made the year much more challenging for professional investors as the performance of the market has been highly concentrated (even more so than mentioned in our previous newsletter). What makes this a bit concerning is that this performance was driven by multiple expansion (i.e. positive sentiment) versus an increase in earnings expectations…

…a big contributor to this has been the excitement in Artificial Intelligence (AI).

Artificial Intelligence (AI).

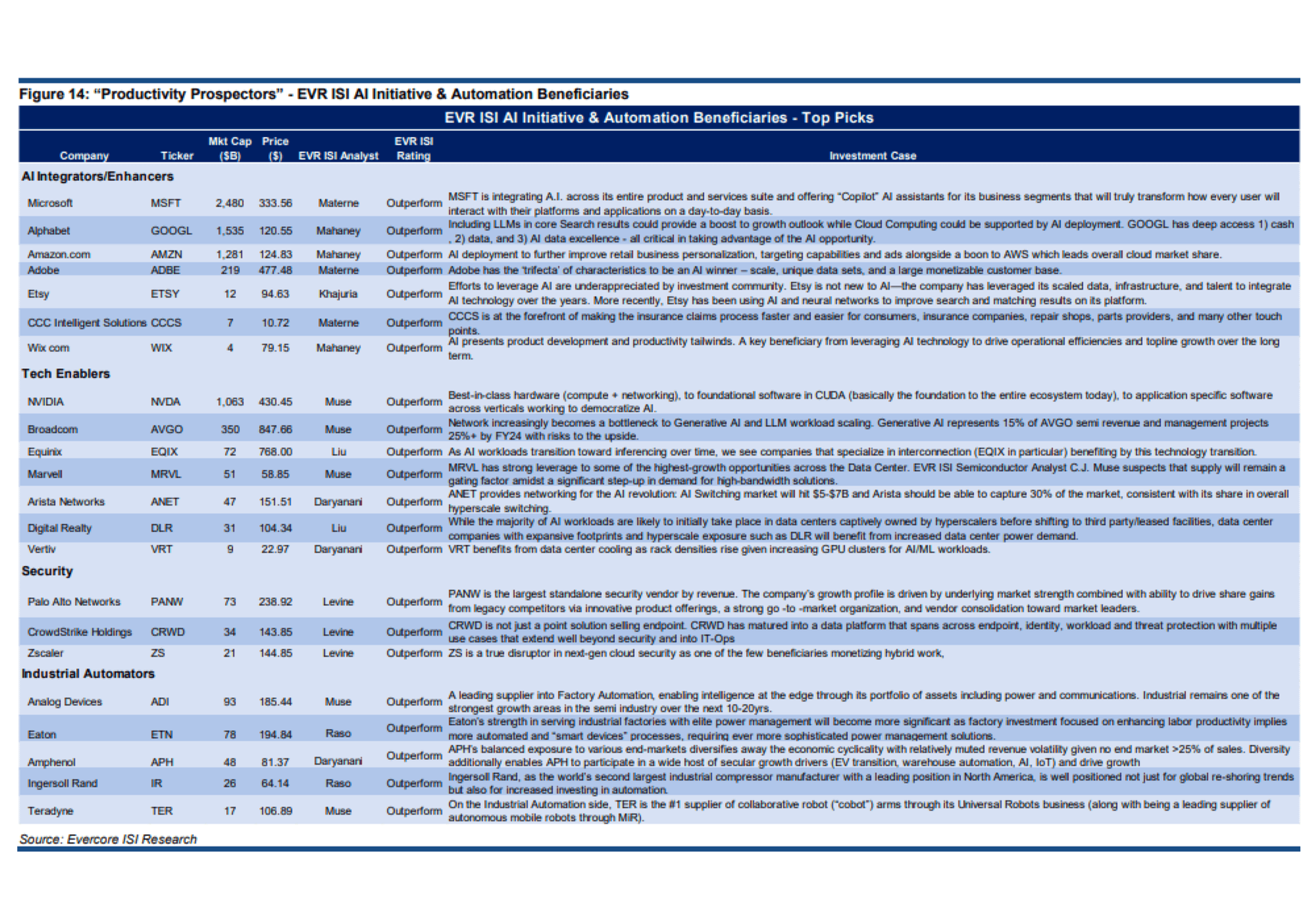

There has been a continued focus in this area of the market and the excitement and hope is warranted as several companies have reported above consensus expectations due to better growth driven by demand for AI products. With the labor costs continuing to be stubbornly high and unemployment still very low, we do believe AI will be an important factor in fighting inflation. Below we came across an interesting table of companies published by Evercore ISI Research that highlighted companies that could be beneficiaries of this trend…some more directly so than others

Debt.

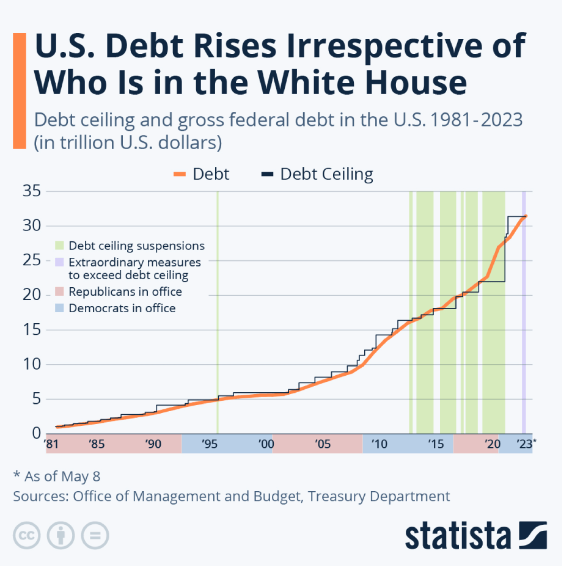

While a government default was averted by an 11th hour deal, no solution was provided to the country’s debt situation. The chart below shows that there likely is not going to be a real resolution to this regardless of who is in office in 2024, but it is something that will need to be addressed by the next president.

The biggest takeaway from this sharp increase in debt is that real GDP has been 1.6% since the Great Financial Crisis while in the 70 years prior to that, it was 3.1%. While the “kick the can down the road” strategy has been moderately successful in avoiding recessions, this slower growth environment has been the price we have paid. The debt issue is something we will address more in depth in the future.

What do we think about the 2H?

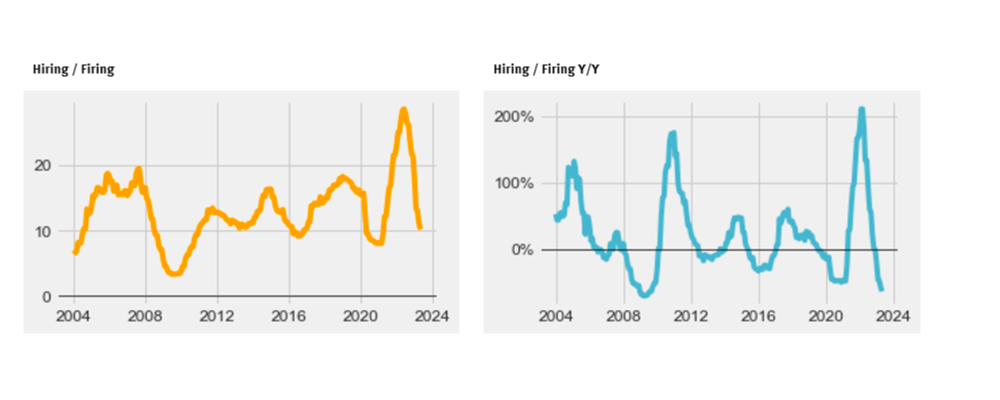

One of the recent surveys we read mentioned that 100% of those surveyed believe that a recession is likely in the coming quarters. Consensus has shifted to expectations of a moderate recession as the economy, thus far, has proven to be resilient despite the sharp increase in rates over the last 12 months and the bank crises in March which have significantly tightened lending conditions. With one or two rate increases remaining in 2023 already expected, we start to think about the opportunity in the second half to be driven by the anticipation of rate cuts in 2024. Unemployment is a key focus for the Fed and analysis of the most recent quarterly earnings calls shows a sharp decline in hirings/firings.

So, over the next several months we lean towards longer duration fixed income and while the bar has been set higher for the larger companies as expectations have increased due to AI, we expect the opportunity to be in a potential recovery of the broader market which may not necessarily yield a significantly higher S&P 500, but a more balanced one.

Important Disclosures

The information contained herein reflects the opinion and projections of Bergamot Asset Management LP (“Bergamot”) as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.