Cassandra Lally

Financial advisors typically advise clients to hold enough money in an emergency fund to cover 3-to-6 months of household living expenses, and in some cases emergency funds are set up to cover a year’s expenses. Unknowingly, many families are keeping these funds in checking accounts, which typically pay very-little-to-no interest. In today’s high interest rate environment, these funds can be earning thousands of dollars more annually in interest, while not taking on any additional risk. Here are three sensible options:

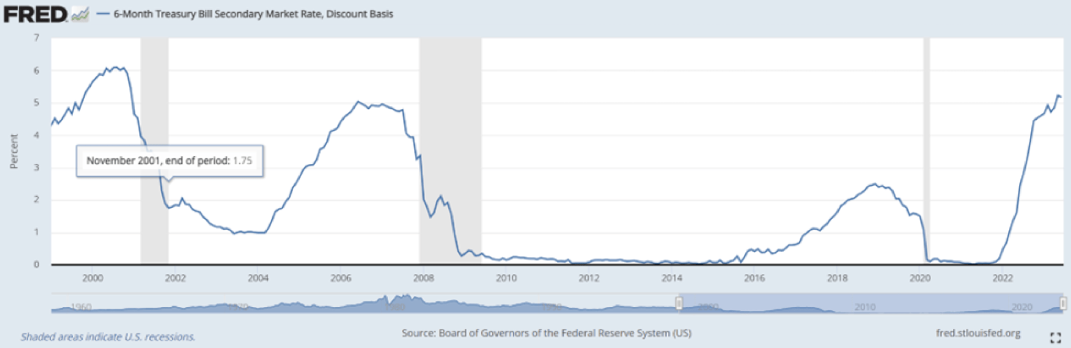

1. Buy Short-Term Treasury Bills.

Short-term treasuries, backed by the full faith of the US Federal government, are a very attractive investment – they currently yield slightly more than 5% and interest is not taxed on the state level, which would benefit residents in states such as California, New York, New Jersey and many others. Additionally, short-term treasuries are fairly easily purchased in a brokerage account or a TreasuryDirect account. However, holders of these bills have to be vigilant in reinvesting the money upon maturity. A way to eliminate the need to closely monitor maturities would be to invest in a short-term treasury ETF, such as BIL (SPDR® Blmbg 1-3 Mth T-Bill ETF), but note these investments carry fees (BIL fee = 13.5bp).

2. Move Funds to a High-Yield Online Savings Account.

These accounts are FDIC insured up to $250,000 per depositor and right now, the best high-yield accounts have rates approaching 5%. Be sure to check the account’s minimum deposit and ongoing balance required and if there are any ongoing account maintenance or other fees. These accounts may also have a limit on the number of times that you can move or withdraw money each month. However, if this is your emergency fund, you should not be touching it often.

3. Purchase a Money Market Mutual Fund.

Money market mutual funds typically invest in very short-term (often overnight) maturity debt securities of investment-grade companies, and thus are minimal credit risk, low-volatility investments despite not being insured by the government. Many top brokerage companies – e.g. Fidelity, Vanguard, Schwab, offer money market mutual funds which have very large diversified portfolios (> $50 billion) and currently yields nearly 5%.