Cassandra Lally

The first day of spring always brings excitement. It is a chance for a new beginning and a fresh start. The flowers start budding, the weather starts getting nicer and the days feel like they are starting to get longer. It also makes me think that golf season is right around the corner. As a recreational golfer, a term I am very familiar with is “mulligan.” For those that do not golf, a mulligan is a do-over or a second chance to hit a shot with no penalty. After the initial attempt of regulators to ease concerns regarding the banking system was somewhat unsuccessful, I am sure they would like a mulligan.

Banks.

For the first time in quite a while, the major headlines for the market are not about interest rates. Unfortunately, banks and the risk of a financial crisis are. We would like to start by saying this is not like 2008 where credit losses and leverage were the driver of the financial crisis. In this situation, it is more one of profitability for the sector as credit generally remains strong. Here is a quick review on what happened last week and where we are today:

Monday 3/13 — Signature Bank (Sunday night) joins Silicon Valley Bank as it is closed by New York State regulators. Despite regulators stating that all depositors (even those with >$250k at the closed banks) will be covered, the banks close down significantly as concerns linger.

Wednesday 3/15 — After a sharp rally on Tuesday 3/15, driven by short covering and hopes of stabilization, concerns regarding Credit Suisse surface and pressure the bank sector once again as fear of contagion reemerges in the market.

Thursday 3/16 — Concerns of a bank run continue for First Republic Bank and consortium of 11 banks (led by J.P. Morgan, Bank of America, Citigroup and Wells Fargo) deposit $30b in uninsured deposits to inject liquidity and provide stability to the bank.

Friday 3/17 — Swiss authorities press for a merger between UBS and Credit Suisse to stem the crisis of confidence in the country’s banking system.

Sunday 3/19 — UBS pays $3.2b to acquire Credit Suisse. The company was valued at $9.5b on Friday. The Swiss National Bank also agrees to offer a $107b liquidity line to UBS.

Interest rates and the US economy.

The sharp increase in interest rates over the past 12 months are what has caused some of the problems the banks are currently experiencing with regards to losses on bond investments that they have to realize to fund client withdrawals. While the economy remains steady and inflation is running slightly above expectations, the Fed will likely slow increases and continue to monitor the data as this tightening cycle nears the end. The focus over the next several quarters will be more of when does the Fed pause and then begin to look to lower rates or ease.

Markets.

One of our thoughts as the past week had us brushing off our playbook from 2008/2009 was the following:

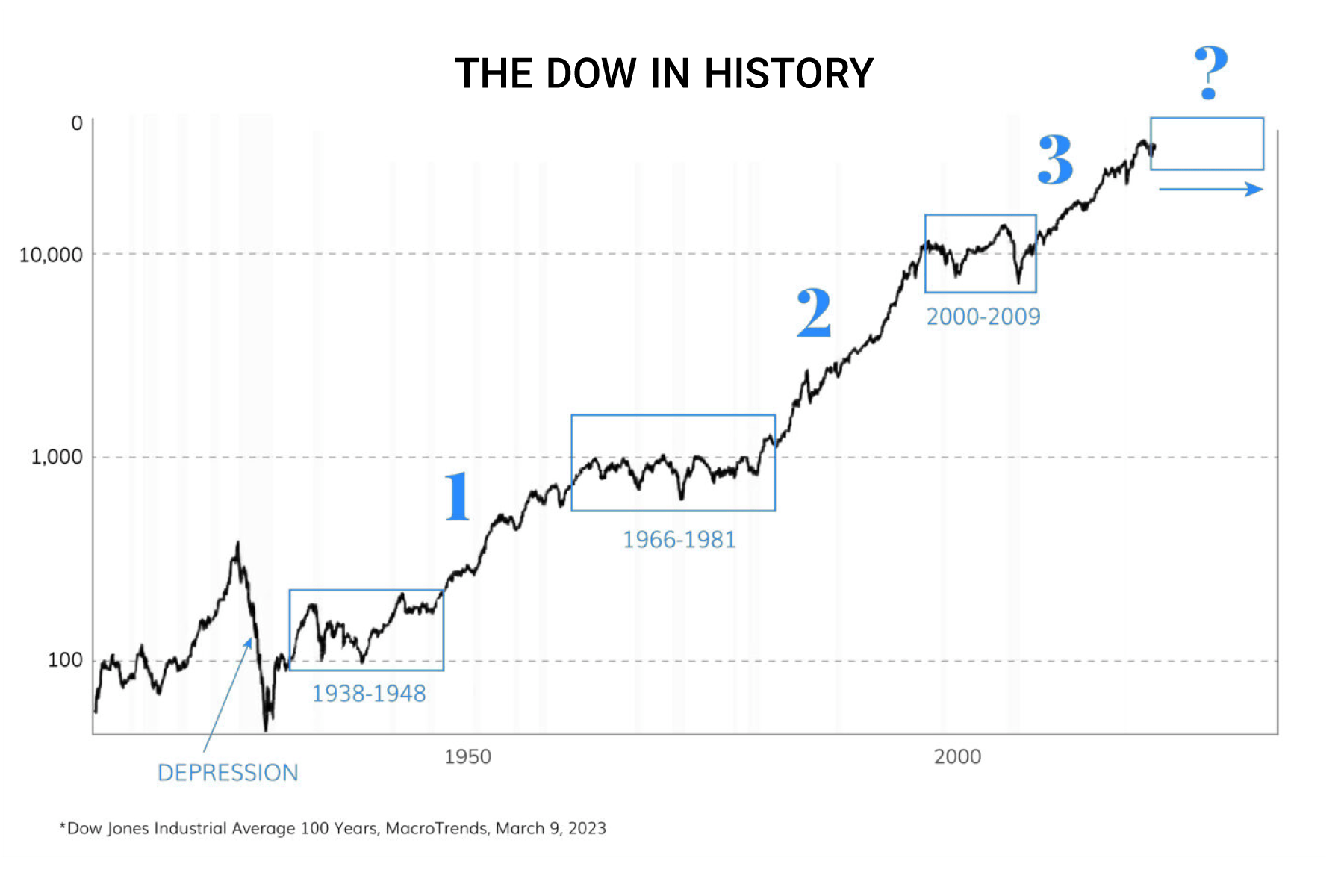

After strong periods in the market, as we have experienced in the past 13 years, there are periods of “lost decades” where the market remains essentially flat overall for an extended time as fundamentals and reality catch up with the previous exuberance. This is something we are mindful of as we continue to focus on the lack of growth opportunities of the various sectors. However, the one driver that does keep us hopeful is the eventual lowering of rates over the next 12-24 months, which the market will try to anticipate, as we have seen already.

Overall, we believe that the issue with the banks should subside over the next several weeks as regulators use their “mulligans” to figure out what will ease investor angst. As we believe that this is a profitability issue, not a systemic issue for the financial system, investors will return to focusing on inflation and growth. The lackluster fundamentals will continue to keep the market range bound and ultimately continued patience will prevail.