Get Connected

In the The Wizard of Oz , Dorothy is caught in a tornado, is whisked away from her home and eventually lands in the magical land of Oz where there is a new reality and anything is possible. The last four weeks feel like a tornado just went through the markets. Like a tornado ripping through a town, following its path shows the damage is usually quite significant, however, nearby, where it misses, it does not look like anything happened at all.

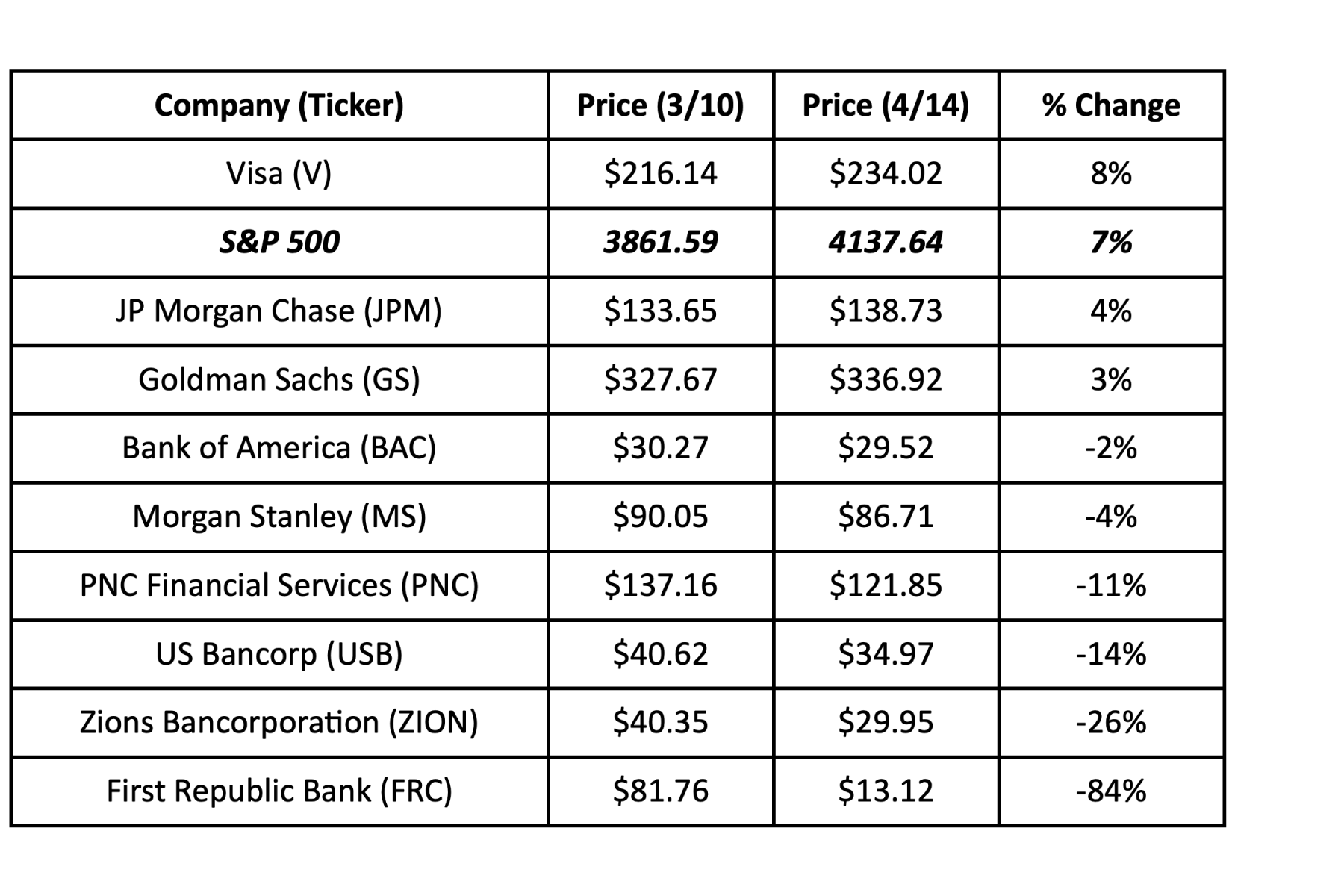

Financials.

As the sector that was hit by the “tornado” here is a snapshot of some of the key stocks. Not including the companies that went to “zero” (Silicon Valley Bank and Signature Bank) it is quite a dispersion, with the larger banks being mostly immune and the smaller banks taken the brunt of the decline:

The actions taking by the Fed that we discussed previously seem to have been successful so far in easing investor and bank customer concerns. A sign of this is that in the last week of March, the Federal Home Loan Bank system issued $37b in debt which is sharply down from $304b just two weeks before.

What could be the next area of concern? Analysts are focusing on commercial real estate (CRE). Morgan Stanley estimates that almost a third of the $4.5t US CRE debt is coming due by 2025, with the biggest area of concern being in low investment grade companies since refinancing at higher rates has the potential to significantly impact earnings at a time when the economy could be in recession. Focusing on high investment grade companies, where their cash flows more than cover any debt obligations despite higher interest rates is the preferred option.

Technology.

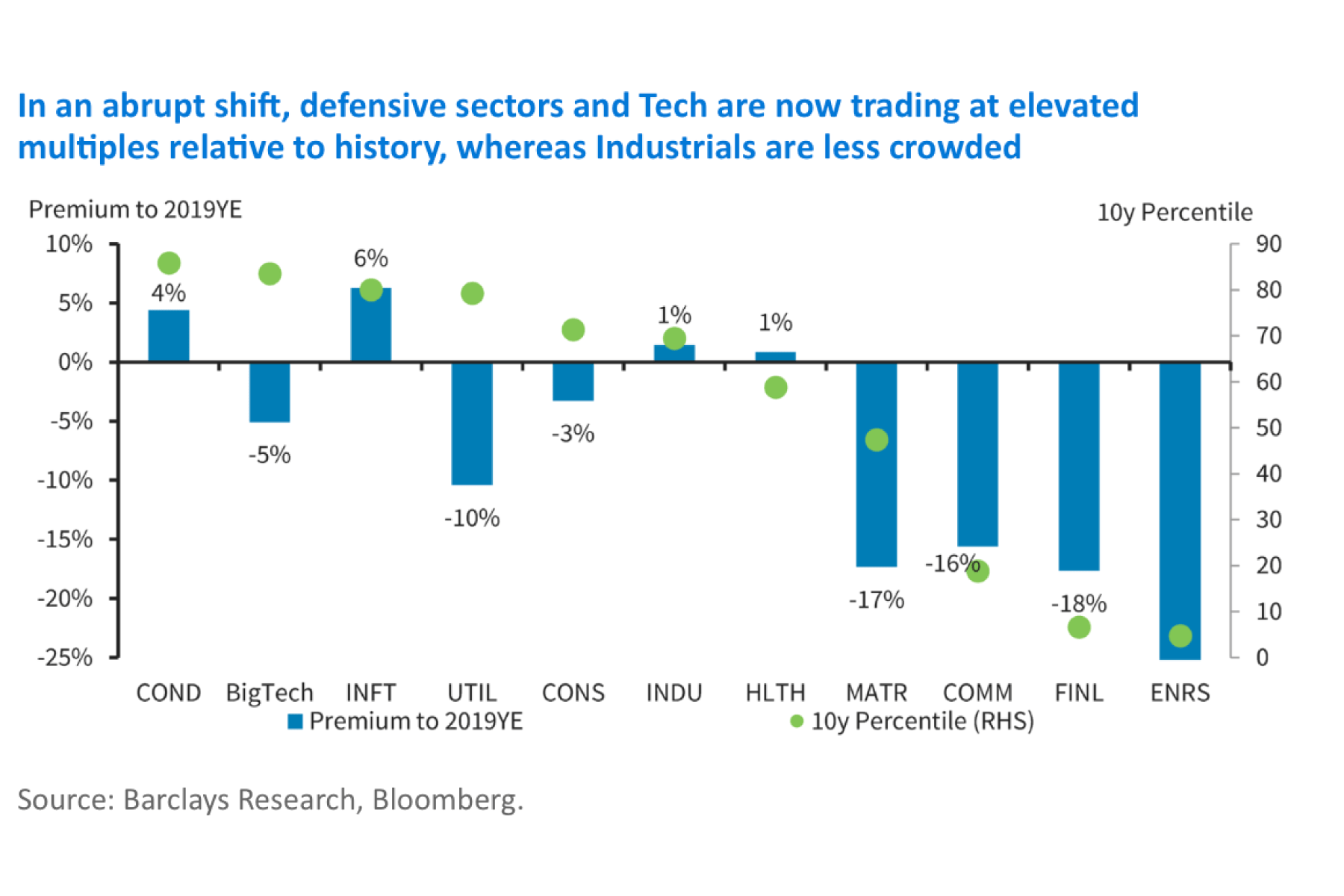

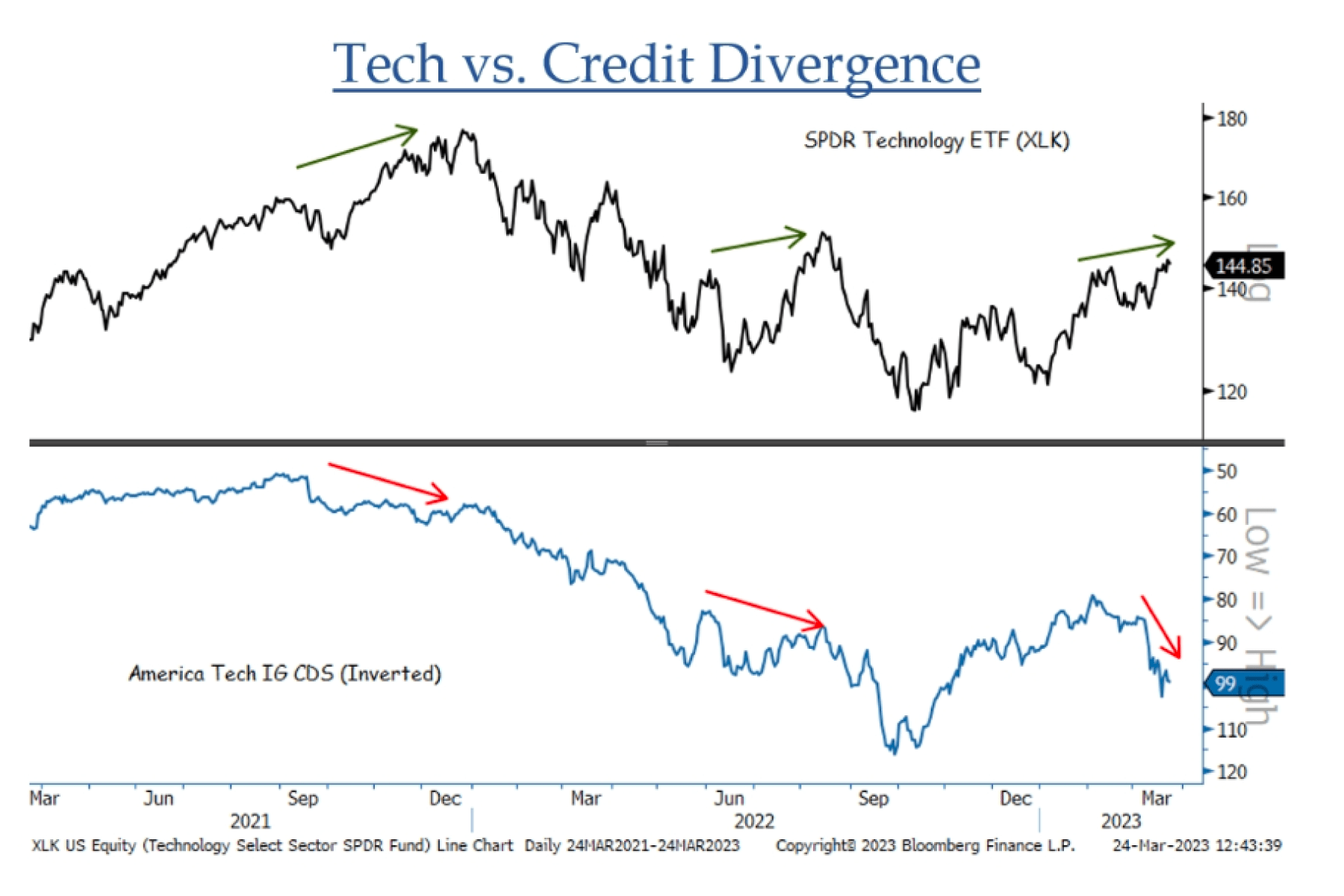

Not so dissimilar to the Financials, Technology stocks (which are amongst the largest companies in the market) have been a safe-haven, despite negative earnings revisions. This outperformance has made them “expensive” versus recent history.

…additionally, within technology, semiconductors (SOX) which are typically early indicators of a recovery have also been strong despite the recent spate of negatives…

Interest Rates/Inflation.

This continues to move down the list of things we write about. Inflation is moving in the right direction and the impact of the interest rate increases in the last year have been successful in tightening lending and credit (albeit not without causing a little bank scare). Whether there are one or two more increases is mostly irrelevant for markets at this point. The only question that remains is how long is it until the Fed lowers rates.

Recession.

With the recent deposit crisis in the regional banks, tighter lending conditions are likely to impact small and medium businesses (SMBs) disproportionately. With SMBs generating 40% of US GDP and employing 50% of the workforce (while responsible for creating 2/3 of jobs), most industry executives and investors believe that a recession is inevitable. The base case is a recession later this year, or early in 2024. Consensus is calling for a “mild” recession. What we will continue to monitor closely is the potential risk for something deeper or prolonged.

What does all this tell us? "There's no place like home."

Several things stand out as I write this. The main one is, this might be the most anticipated recession in several decades. With that being said, while there may not be significant downside in the market as investors anticipate interest rates to be CUT some time in the next 12 months, the upside also seems somewhat limited as we use market valuations AND upside to growth expectations as our guidepost as to what type of upside there could be. In this “Land of Oz” where the market has been treating bad news as good news, eventually bad news will be treated as bad news which is what puts a ceiling on markets in the near term.

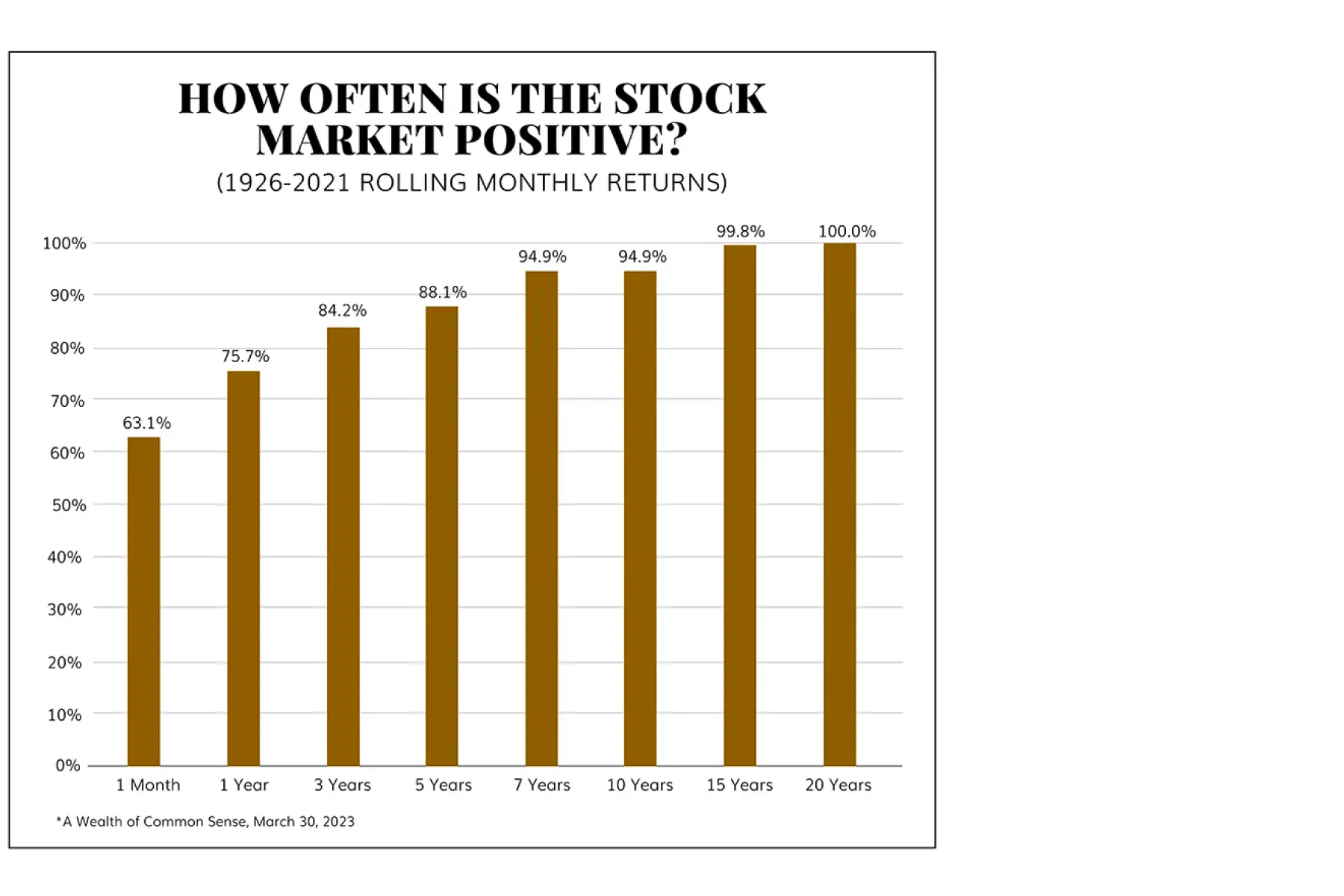

We will end on a positive note. Over the long term, the market is usually positive…

…so while we expect it to be bumpy over the next several quarters, we will “click our heels” and look forward to getting back to a more “normal” reality.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use