Cassandra Lally

“It’s the first day of autumn! A time of hot chocolatey mornings, and toasty marshmallow evenings, and, best of all, leaping into leaves!” – Winnie the Pooh

With the sharp change in temperature this weekend, we can unofficially welcome fall as it is now time for sweaters, the changing of the leaves and in retail, pumpkin spice everything. In finance, it’s a good time to look back at how the year has played out so far and think about how we want to position for the balance of the year, with an eye out for 2024.

So, what are we monitoring?…

Interest rates / Unemployment.

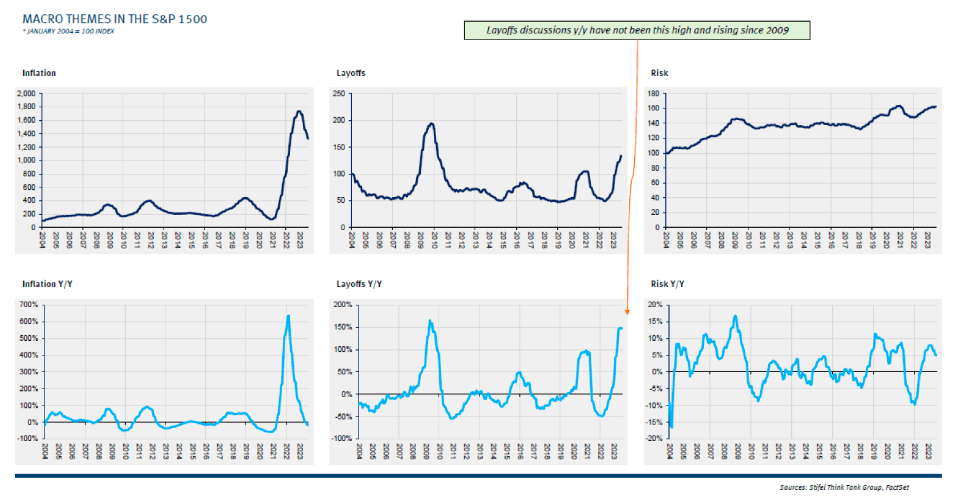

While we continue to reference interest rates in our newsletters, we are confident that the cycle is near the end. There is likely one, maybe two increases left in this tightening cycle. With layoffs discussions sharply upticking to highs we have not seen since 2009, this is one of the key signs for us that a slowdown is imminently upon us…

China / Europe.

China’s share of global GDP is nearly 20%. The post-COVID recovery in China has been lackluster versus the rest of the world, which is especially surprising given the way the country was shut down. Until late last week Chinese economic data has been mostly negative. The property markets continue to exhibit massive problems and the rate cuts being implemented are being viewed as a panic response. Politically, for the first time ever, retired Communist Party elders reprimanded Xi Jinping and also China’s Defense Minister has gone missing. Longer term, there is demographic problem where the population is expected to SHRINK by approximately 60 million people over the next decade. This will create problems such as reducing the size of the labor force (eroding consumption) while requiring increases in spending on healthcare and pensions. While possible that a lot of this may already be discounted by the markets, outside of government stimulus, it is very difficult to see how this is all resolved in the near-term.

In Europe, while the ECB raised rates last week by another 25 basis points, like here in the US, we are likely near the end of the rate increase cycle. With inflation high, but moderating, there are signs of weakness emerging due to higher interest rates and tight lending environment. One example is the Organisation for Economic Co-operation and Development (OECD) warning a wave of bankruptcies that threatens the Eurozone economy.

US Consumer.

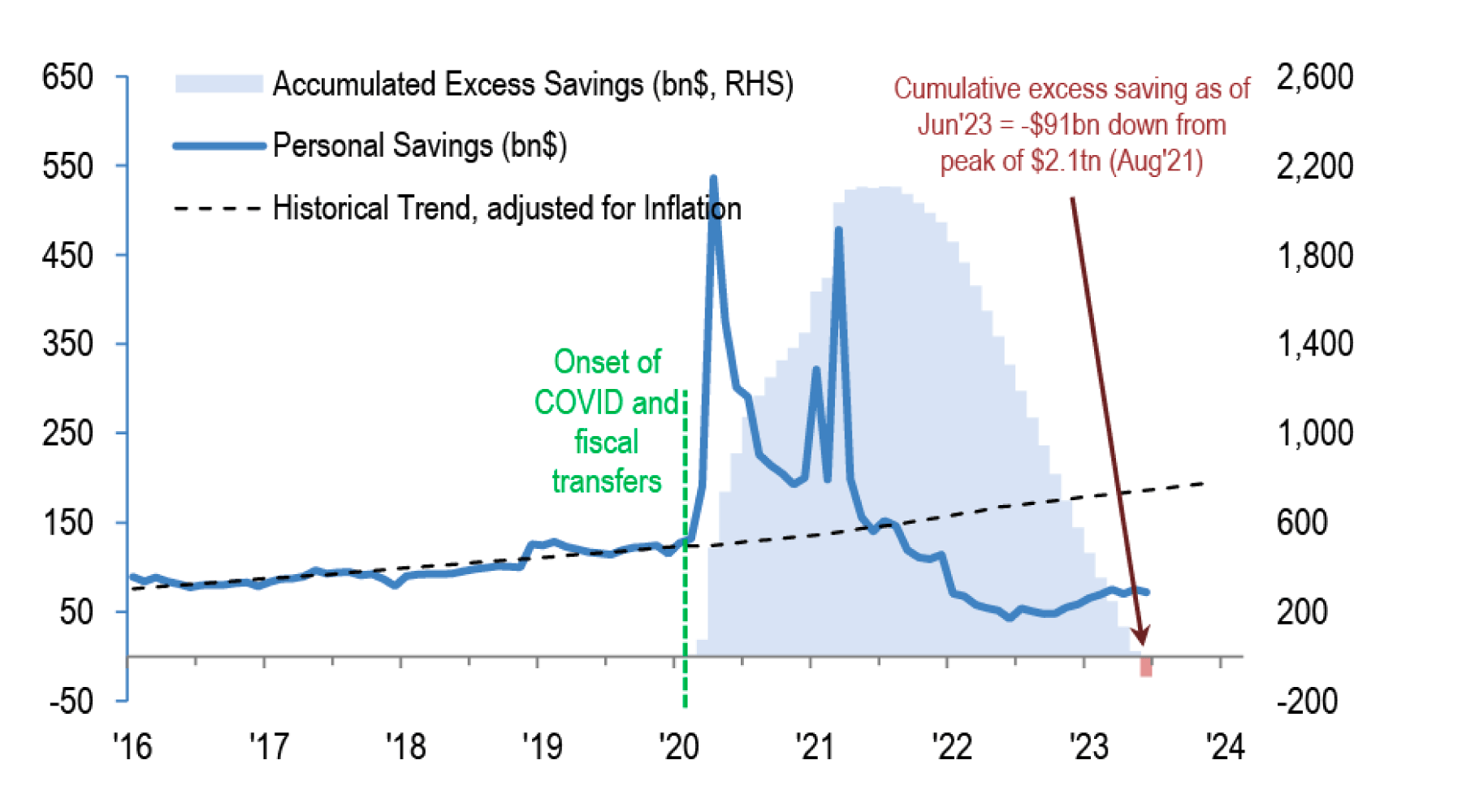

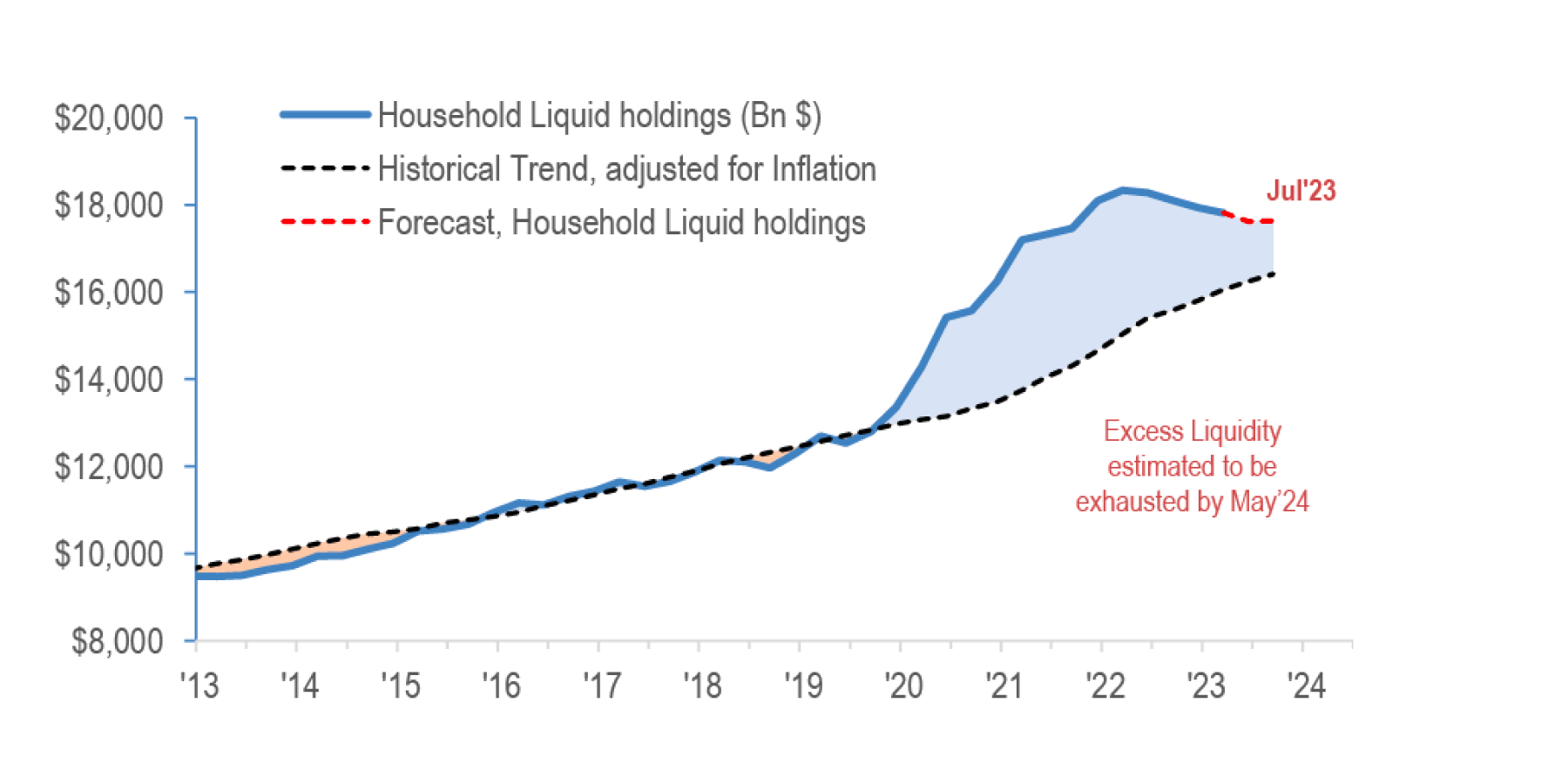

Consumer consumption is roughly 2/3 of US GDP. Historically, the consumer has been extremely resilient. While now beyond lapping many of the government stimulus programs, tight lending standards, higher interest rates and the restart of student loan payments are all headwinds for the consumer. While not overly alarming, savings rates are declining and household liquidity is normalizing.

The Markets.

Earnings for the S&P 500 have been extremely resilient given the cost cutting initiatives at the large cap companies and the strength in artificial intelligence. 2023 consensus is roughly $219, while 2024 consensus is at $246. This will continue to support the S&P 500, though the market is not “cheap” at 18x out year earnings, should consensus hold and we have growth in 2025, it is not grossly “expensive” either.

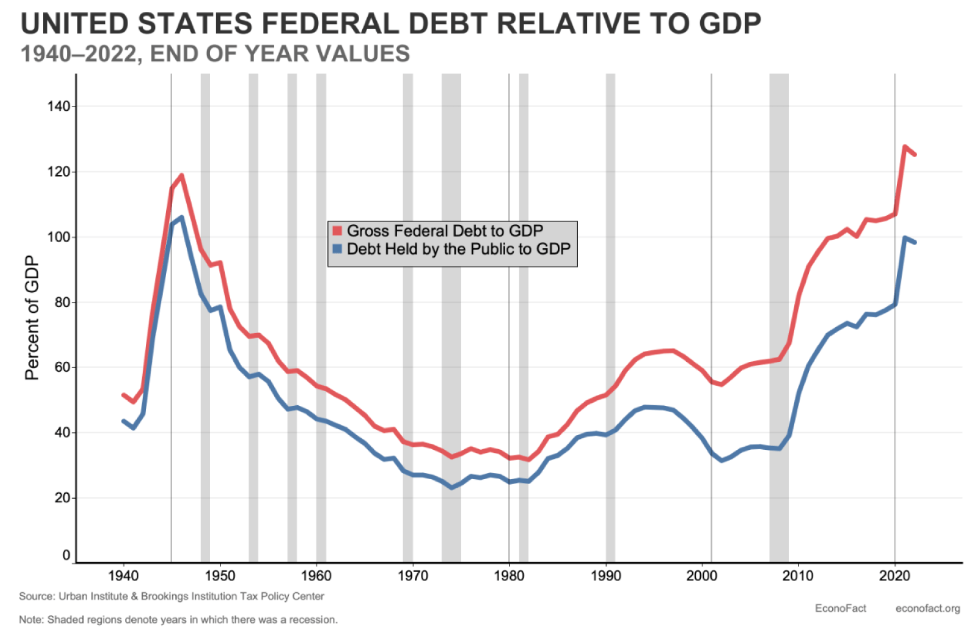

US Debt.

The single largest increase in debt was that of government debt jumping from 102 percent of GDP before the pandemic to 124 percent in the first quarter of 2021. This increase was associated with a large fiscal response to the pandemic recession undertaken by the US federal government, notably through the $2.2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act of March 2020 and the $1.9 trillion American Rescue Plan of March 2021.

While this is the elephant in the room, as long as there is long-term economic growth, investors tend to not focus on this so much. Without much growth, the likelihood is that we experience what Japan has over the last 40 years.

Overall, while there is slightly more caution in our view for the markets overall (given some of the items discussed above), similar to what we have said before, we still feel there are excellent opportunities in Utilities (strong demand drivers in Electric Vehicles and Artificial Intelligence/Data Centers) and Long Duration Fixed Income due to the end of the rate increase cycle.