Get Connected

First, a very belated Happy New Year to all. With the recovery of the S&P 500 in 2023, despite the narrowness of it led by the Magnificent 7, 2024 promises to be an interesting year with interest rate increases and inflation likely behind us, the Chinese economy continuing to struggle, recession concerns waning and an election in November. The S&P 500 has started the year +5.54% in a continuation of what we saw at the end of last year, led by NVIDIA Corp (NVDA) + 50.75%, Meta Platforms Inc (META) +36.68%, Amazon.com (AMZN) +13.06% and Microsoft Corp (MSFT) +8.95% (all returns through 2/16/23).

So, what’s on our mind?…

Rate Cuts.

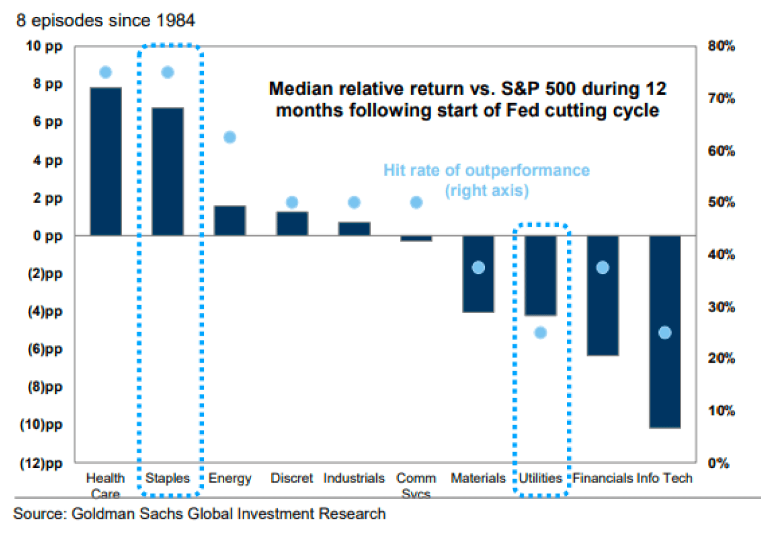

The base case to start the year was an expectation for 6 rate cuts in 2024. With a slightly “hot” CPI for January, the 10-year Treasury increased by roughly 25bp over the past several weeks. The first cut, originally, expected in March, has now been pushed out till what is now likely May. Our position has always been following what the Fed has been consistently messaging, that the rate of change of interest rates will be contingent on economic data. With inflation slowing and GDP still positive, there is no rush for the Fed to lower rates. While we expect the Fed to cut rates later this year, our expectation is for 3 cuts. Below is a chart that shows how various sectors of the market have performed in previous rate cut cycles since 1984:

China and Other International Markets.

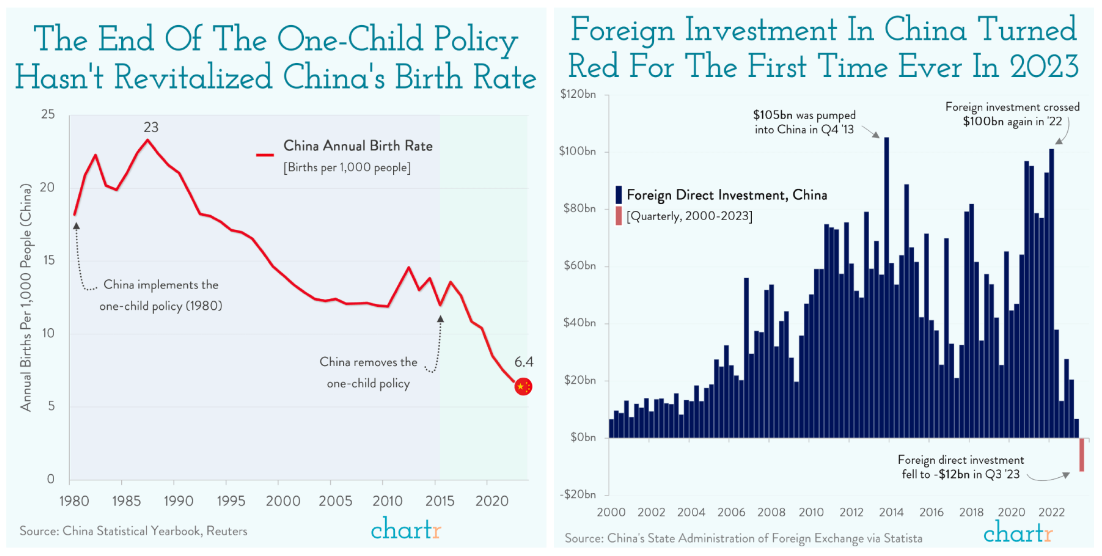

China continues to be challenging since the real estate crisis and the crackdown of technology companies over the last 2 years. The problems are secular and will be challenging to address. We have discussed the declining population of China in the past, and the chart on the left shows that despite the end of China’s one-child policy, birth rates have not improved. The chart on the right is equally as concerning as it marks the first time in decades that foreign investment in China is negative.

Japan and the UK are both now technically in recession as they reported their second consecutive negative quarter of GDP. Japan’s contraction is connected to its shrinking population (red flag for China per above) as its population declined by almost 1 million people in 2022, the 14 th consecutive year of contraction. The UK differed slightly as population and wage growth were positive but not able to offset a drop in consumer spending. The rest of Europe is likely not far behind, which ultimately will set up for slowing inflation and rate cuts in the region in the near future.

Elections.

This will be an interesting “wild-card” to monitor as it becomes clearer over the next several months who will be representing each party as the presidential nominee as well as their respective running mates. Also of importance will be the make-up of Congress as that will dictate how much the winner will be able to execute their agendas. In the near-term, the economy should be able to sustain enough momentum into the election with the recent strength and the potential backdrop of the Fed lowering rates. Stay tuned…

Random Anecdotes.

Here is a collection of some interesting random anecdotes that could have impact on different areas of the market:

- Novo Nordisk is getting calls from food makers as they face up to the potential threat from its appetite-suppressing drugs. CEO Lars Fruergaard Jorgensen said “scared” food bosses want to know how the treatments work and how fast they’ll roll out. – Bloomberg

- UK CPI for Jan modestly undershoots the Street in Jan (core +5.1% vs. the Street +5.2% and headline +4% vs. the Street +4.1%), a relief for markets after the US reading on Tues. – Reuters

- Saudi Arabia decided to halt its oil capacity expansion plans because of the energy transition, its energy minister said on Monday, adding that the kingdom has plenty of spare capacity to cushion the oil market. – Reuters

- China’s government spending will rise this year, the nation’s Minister of Finance said, as authorities look for ways to bolster domestic demand and help the world’s second-largest economy regain momentum. “We will make sure the overall size of fiscal spending increases to play a better role stimulating domestic demand,” Finance Minister Lan Fo’an said. – Bloomberg

In summary, for 2024 while there is:

- Weakness in the US economy with an increase in layoffs and slowing consumer spending

- Weakness in global economies with China, Japan and Europe showing weak GDP growth and

- Uncertainty in the 2nd half of the year with US elections; the backdrop of slowing inflation and the potential for interest rate cuts around the world should provide support and minimize the downside for global markets and eventually provide for a broader cyclical economic recovery.

Let our experienced investment team guide you on your journey to growing and protecting your wealth. Contact us today to begin a conversation.

Quick Links

Contact Details

IMPORTANT DISCLOSURES

Bergamot Asset Management LP (“Bergamot”) is registered with the state of New Jersey as an investment adviser located in Princeton, New Jersey. Bergamot and its representatives are in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which Bergamot maintains clients. Bergamot may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Bergamot’s web site is limited to the dissemination of general information pertaining to its investment advisory services. Accordingly, the publication of Bergamot’s web site on the Internet should not be construed by any consumer and/or prospective client as Bergamot's solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Bergamot with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of Bergamot, please contact the state securities law administrators for those states in which Bergamot maintains a notice filing. A copy of Bergamot's current written disclosure statement discussing Bergamot's business operations, services, and fees is available from Bergamot upon written request. Bergamot does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Bergamot's web site or incorporated herein, and takes no responsibility therefor. All such information is provided solely for informational/convenience purposes only and all users thereof should be guided accordingly. Registration of an Investment Adviser does not imply any level of skill or training.

Each client and prospective client agrees, as a condition precedent to his/her/its access to Bergamot’s web site, to release and hold harmless Bergamot, its officers, directors, owners, employees and agents from any and all adverse consequences resulting from any of his/her/its actions and/or omissions which are independent of his/her/its receipt of personalized individual advice from Bergamot.

The information contained herein reflects the opinion and projections of Bergamot as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. Bergamot does not represent that any opinion or projection will be realized. All information provided is for informational purposes only and should not be deemed as legal, tax, investment advice or a recommendation to purchase or sell any specific security. This shall not constitute an offer to sell or the solicitation of an offer to buy any interest in any fund managed by Bergamot or any of its affiliates. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Market conditions can vary widely over time and can result in a loss of portfolio value. Past performance does not guarantee future results.

All Rights Reserved | Bergamot Asset Management LP | Privacy Policy | Terms of Use