Cassandra Lally

With the recent events in the Middle East, the Russian invasion of Ukraine in 2022, the potential for some kind of conflict in Asia with the saber rattling of North Korea and China, in addition to the divide that is taking place in this country, we hope and pray that sooner than later, cooler heads will prevail and that we can focus on addressing the bigger issues that the world is facing.

What else is on our mind?…

Interest rates.

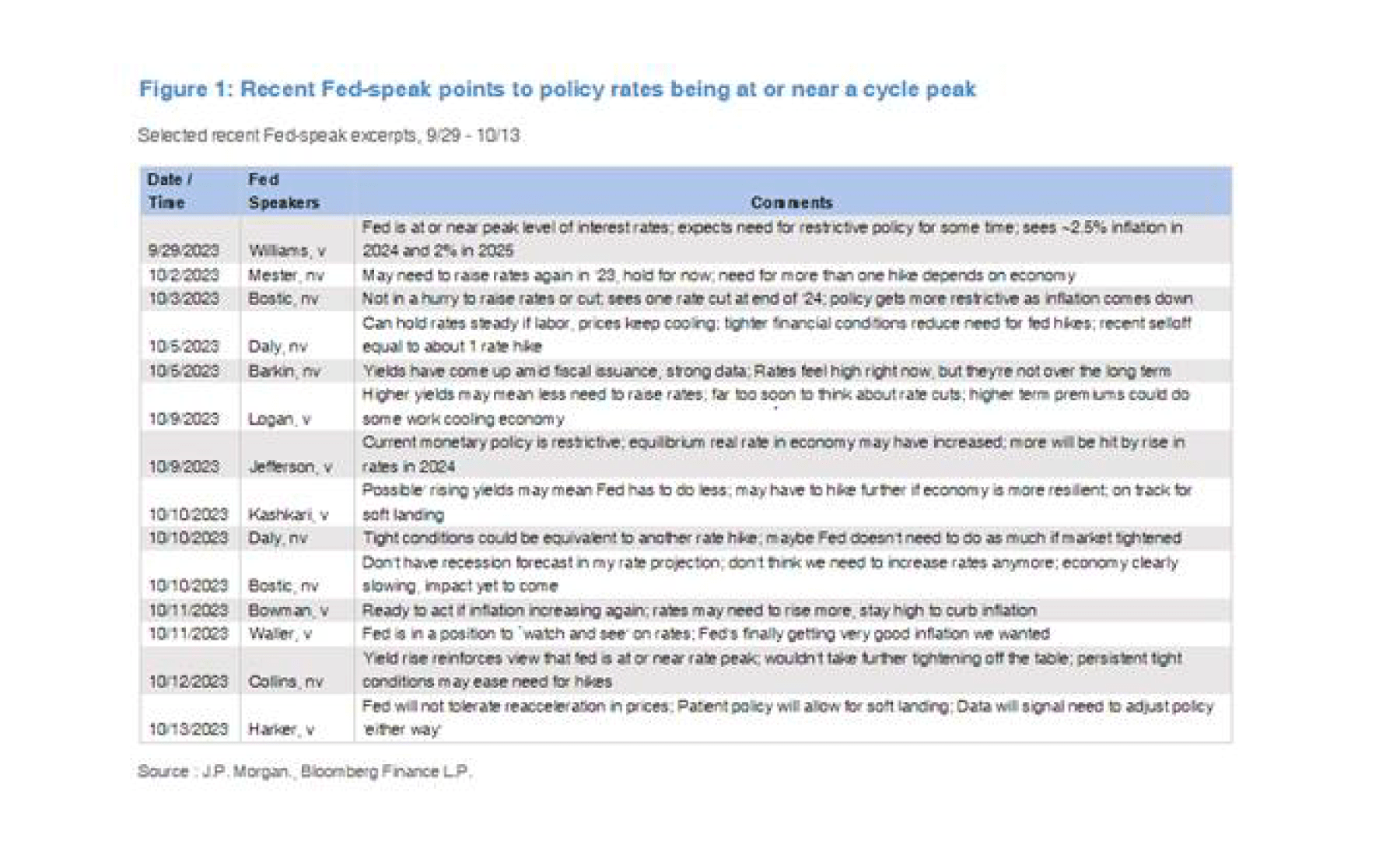

With each monthly newsletter, we hope that we can move this topic down the list of priorities and then finally off it and move on to another topic. Unfortunately, the sharp move in the bond market in the last month leaves it in focus as the 10-year Treasury yield is up nearly 1% to just below 5%. That being said, below is a nice table put together of recent “Fed speak” which points to us being at or near a cycle peak.

China.

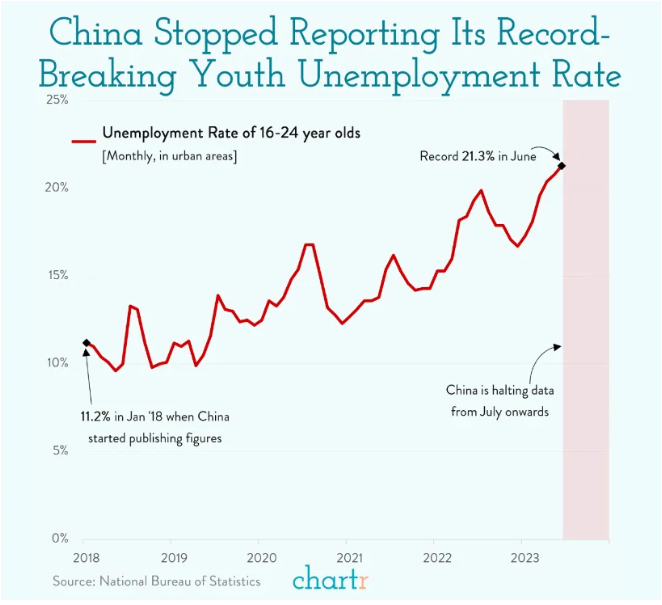

The second largest economy in the world continues to struggle. While recent data shows some stabilizing, it is very difficult to put much weight in the government reported numbers when anecdotes continue to be very challenging. Bailouts continue in various segments of the economy, especially within real estate, with Country Garden, China’s largest property developer, essentially defaulting on its debt. This follows Evergrande which at the time was the second largest property developer in China. We previously mentioned the demographic issue of the shrinking population of China over the next decade. Unemployment continues to be an issue. While this chart is from early this summer, we would imagine that the issue of youth unemployment has only gotten worse…

GLP-1.

This stands for glucagon-like peptide 1. This is a type 2 diabetes drug class that is now all the rage as it is now used for weight loss. Companies such as Novo Nordisk and Eli Lilly have seen a significant benefit in their stock prices from this, while other companies, such as medical device companies that are perceived to have benefited from obesity have seen sharp declines. Even Walmart went as far as to say that they have seen a “slight change” in food purchasing habits of people taking Ozempic and other similar drugs. As with most things, the impact is likely somewhere in the middle. While the weight loss is valid, the longer you are on them and the higher the doses taken, the worse the patient feels and most importantly, reimbursement may become more restrictive.

Education.

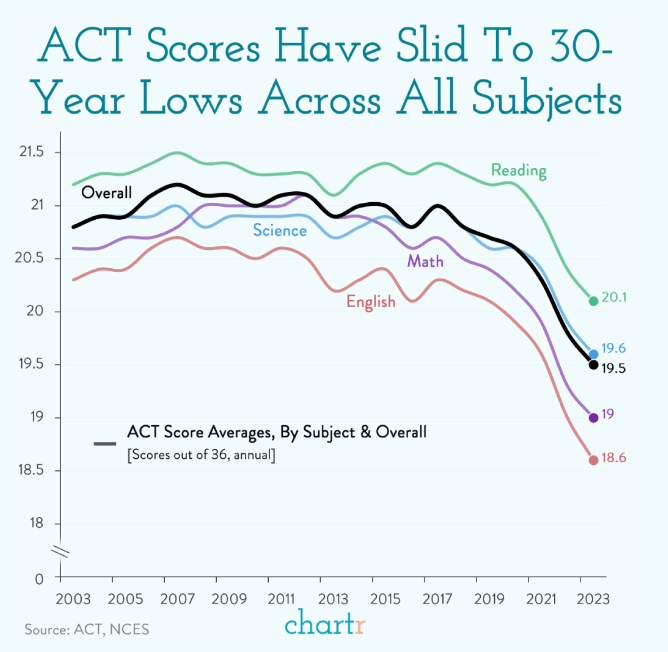

This is a somewhat random topic, though it is something that has come up in multiple discussions regarding long-term trends and some potential lasting impacts from COVID. The declines are alarming across all categories and is hopefully something that our country will focus on remedying immediately.

RISKS & OPPORTUNITIES

In July, we had mentioned several risks and opportunities in the market. We would like to take the opportunity here to revisit and update them.

Risks.

Higher rates for longer. As we discussed previously, inflation has cooled, outside of the recent increase in oil prices, and we are seeing weakness in some segments of the economy. That being said, the economy has been resilient despite the sharp increase in rates over the past year. Higher rates for longer has now become the base case and the recent increase in Treasury yields has reduced the value of bonds, especially those with longer duration. This increases the risk to…

The Economy. Early in the year, there were concerns that a recession was imminent. That expectation was pushed out to “later in the year, or early next year.” We are now “later in the year” and while a recession is not here, the combination of the higher rates discussed above, with geopolitical issues in the Middle East and Europe, as well as a struggling China, should have investors focusing on this possibility.

Opportunities.

We would focus on…

Longer Duration Fixed Income. Is now finally the time? With the recent rise in yields, we think this is an appropriate time to shift more of the portfolio into longer duration fixed income. The 10-year, 20-year and 30-year Treasury yield is now at approximately 5%. With most of our long-term financial plans post-retirement modeling 3.7%, this is a solid opportunity to lock-in at the higher yield as we continue to expect that the Fed will eventually CUT rates within the next couple years.

The resilience of the economy has been somewhat surprising given the continued rise in rates over the past year and the tightening of lending by the financial institutions. The bank “crisis” earlier in the year with Silicon Valley Bank and Signature Bank shutting down is also a curiosity since rates are HIGHER now than they were then. Employment is starting to loosen, consumer savings is back down to pre-COVID levels and there is much uncertainty geopolitically. These concerns keeps us cautious on equity markets overall, however, with interest rates at 5%, there is at least the opportunity to be “paid while waiting” as investors try to identify the next drivers of growth.